Forums

AS18

Accountancy

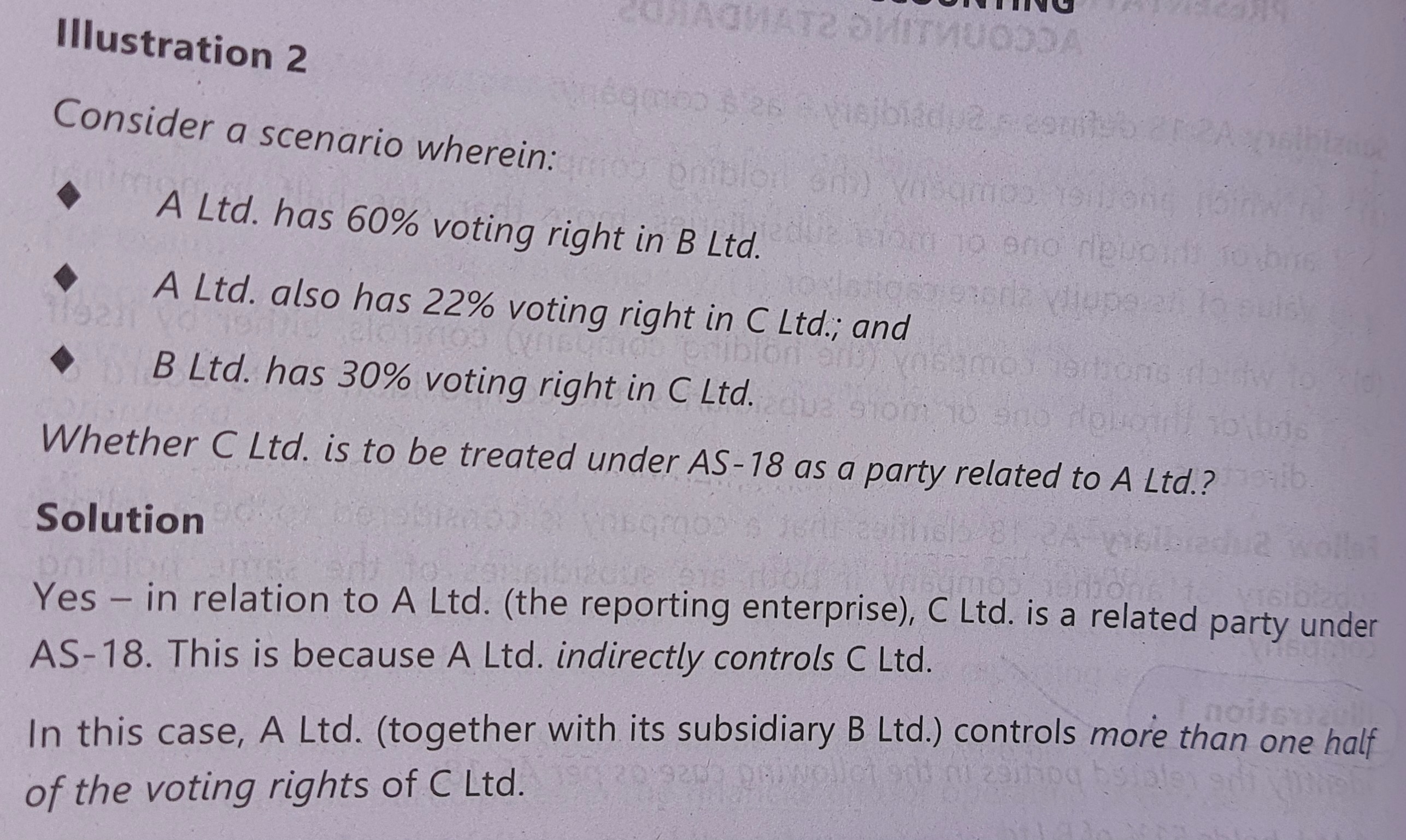

First thing, 60% on 30% = 18% indirect control Second thing, 22% direct control 18+22 = 40% but not more than 50%(more than half voting power) I know that I'm wrong, but tell me why am i wrong. Treat me as a layman.

Answers (3)

Thank you sir, doubt cleared. Let's say ,for the time being, there is no definition given in as18 for a related party relationship; Now i understood that Unlike the relationship of holding subsidiary under AS21 which requires more than 50%, AS18 only requires a significant influence of minimum 20% or more at any cost to be considered as a Related party. That's why in calculation of cost of control under as21, we do the calculation that I've texted above, i.e; 60% on 30%; whereas in as18 , we do take entire voting rights of our subsidiary while calculating the % Am i right sir ?