Forums

Amalgamation query on Debentures discharged

Accountancy

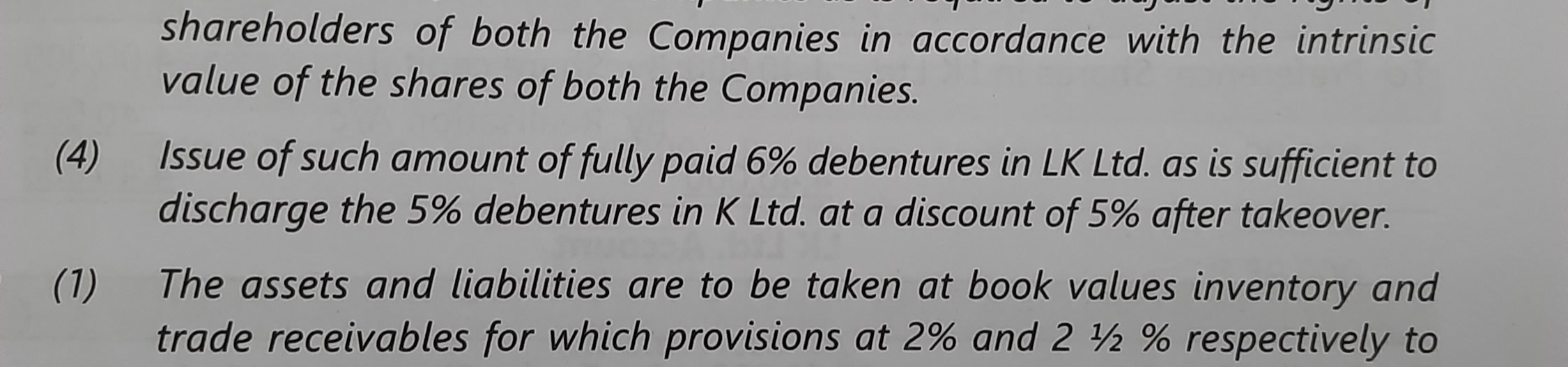

Can anyone pass me the journal entry for this: (K & L amalgamate to form LK Ltd.) Given in Balance Sheet in books of K Ltd: 5% Debentures 2,00,000 Given in Additional Information: Issue of such amount of fully paid 6% debentures in LK Ltd as is sufficient to discharge the 5% debentures in K Ltd at a discount of 5% after takeover. an explanation would be even greater. thanks in advance.

Answers (5)

CA Suraj Lakhotia Admin

5% Debentures 200000 To 6% Debentures 190000 To Capital Reserve/Goodwill 10000

Then, Sir, why has Institute computed Pyrchase Consideration (Net Assets Taken Over) deducting debentures 2 Lacs? Shouldn't it be Rs 190000 as thats the worth discharged to debentureholders of transferor?

CA Suraj Lakhotia Admin

Discharge at discount is after takeover.

Sir, I did not quite follow this. Can you kindly elaborate?

Thread Starter

Kumarjit DeySir, I did not quite follow this. Can you kindly elaborate?

For selling company, valuation is at 100%. Later settled at 5% discount.