Forums

Bank account profit and loss accunt

Accountancy

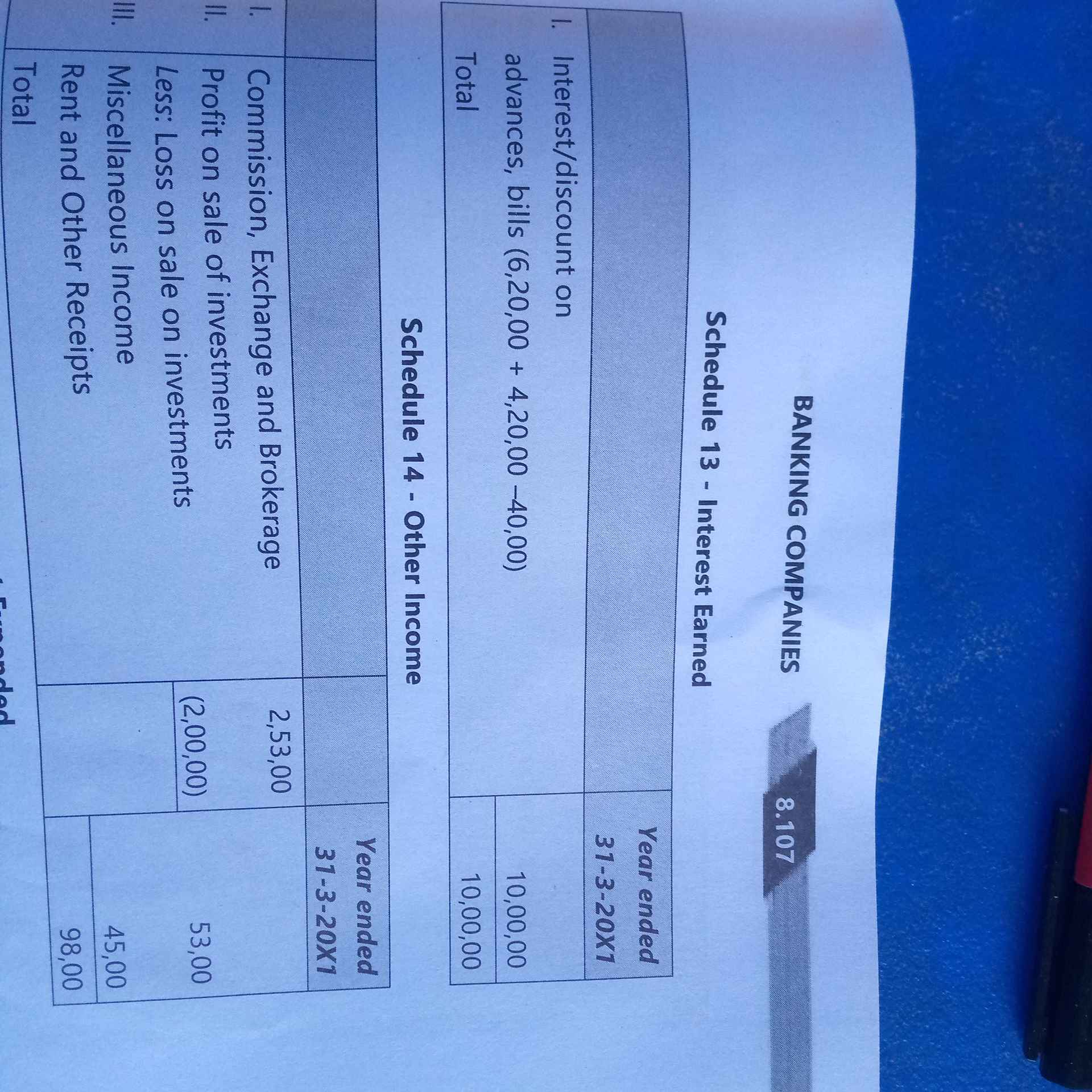

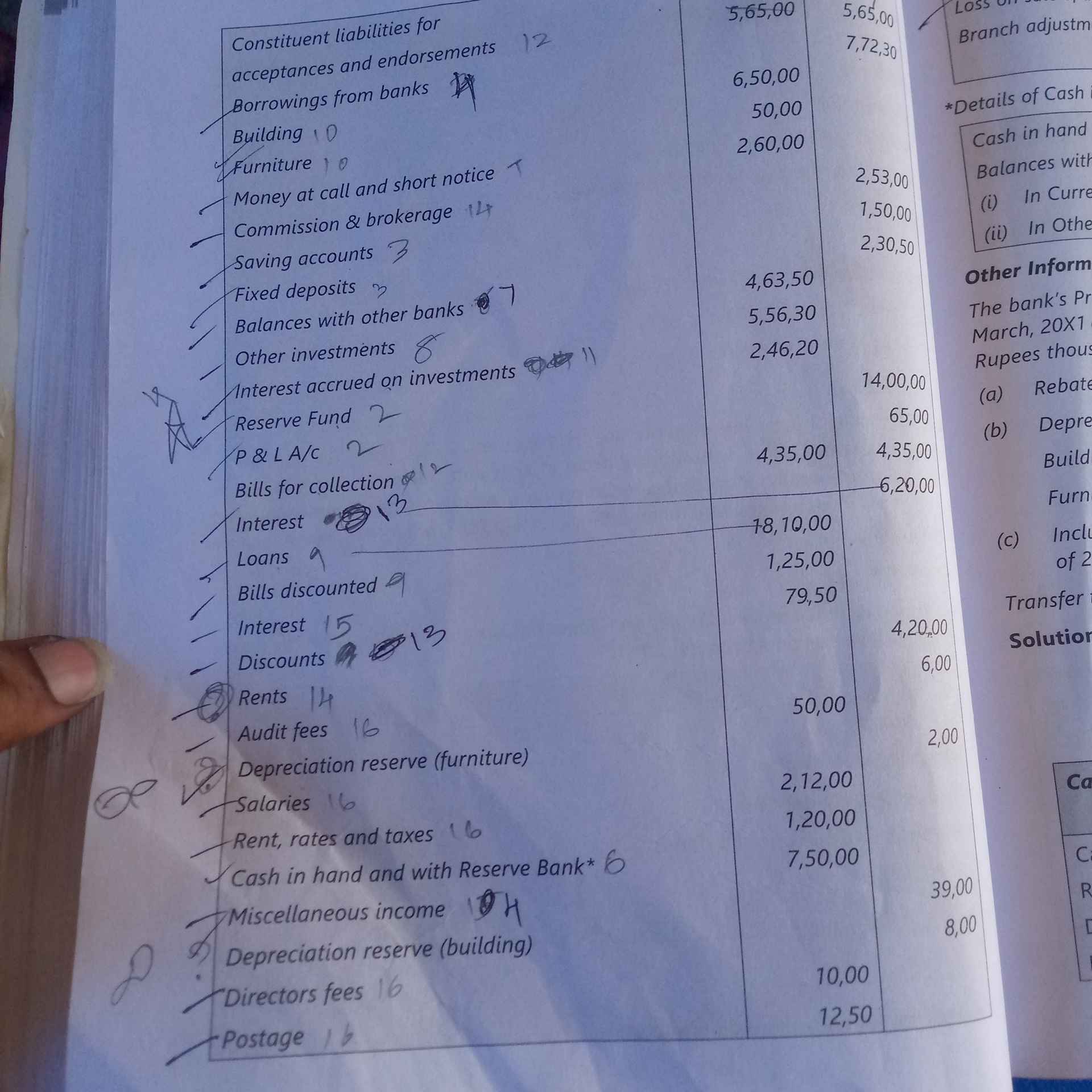

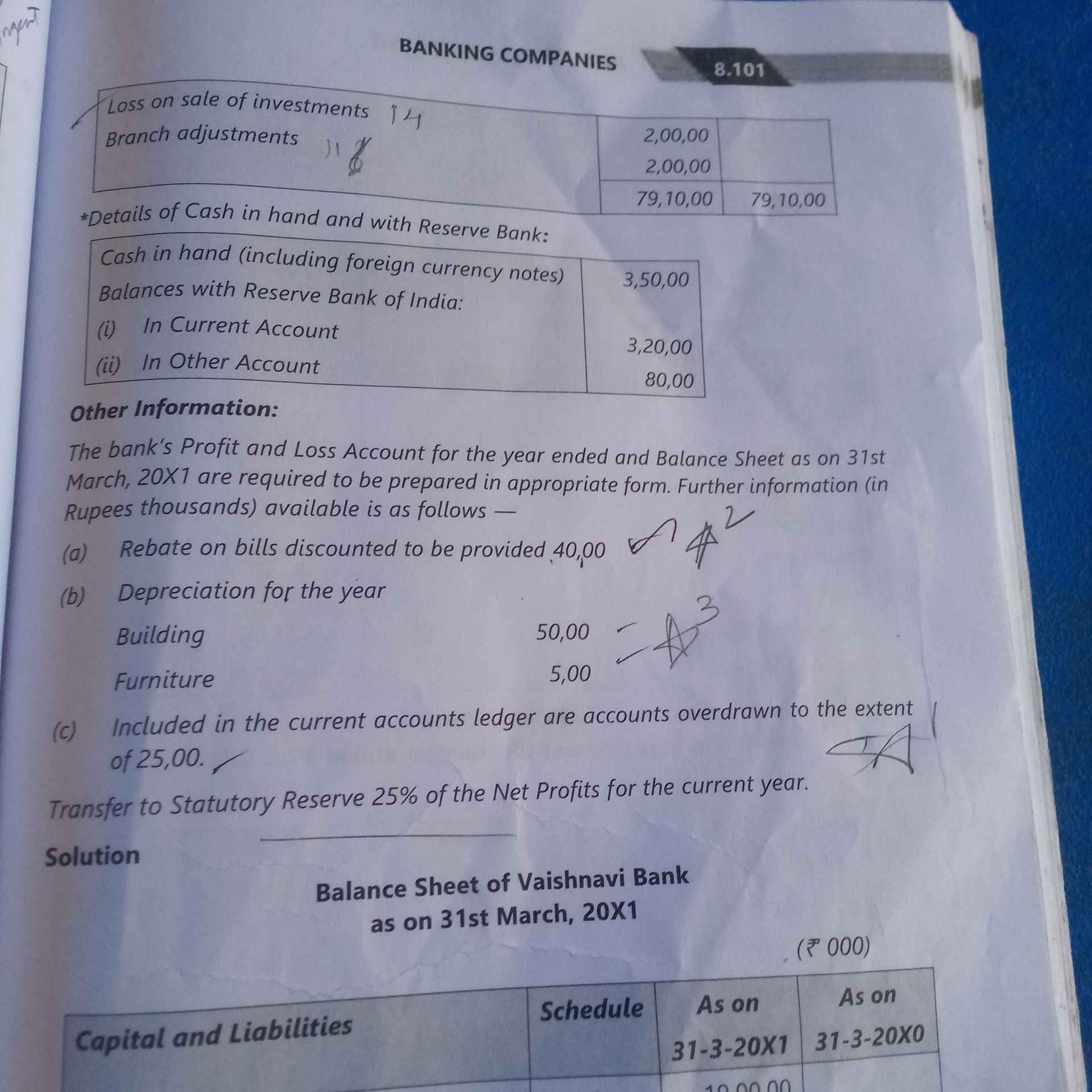

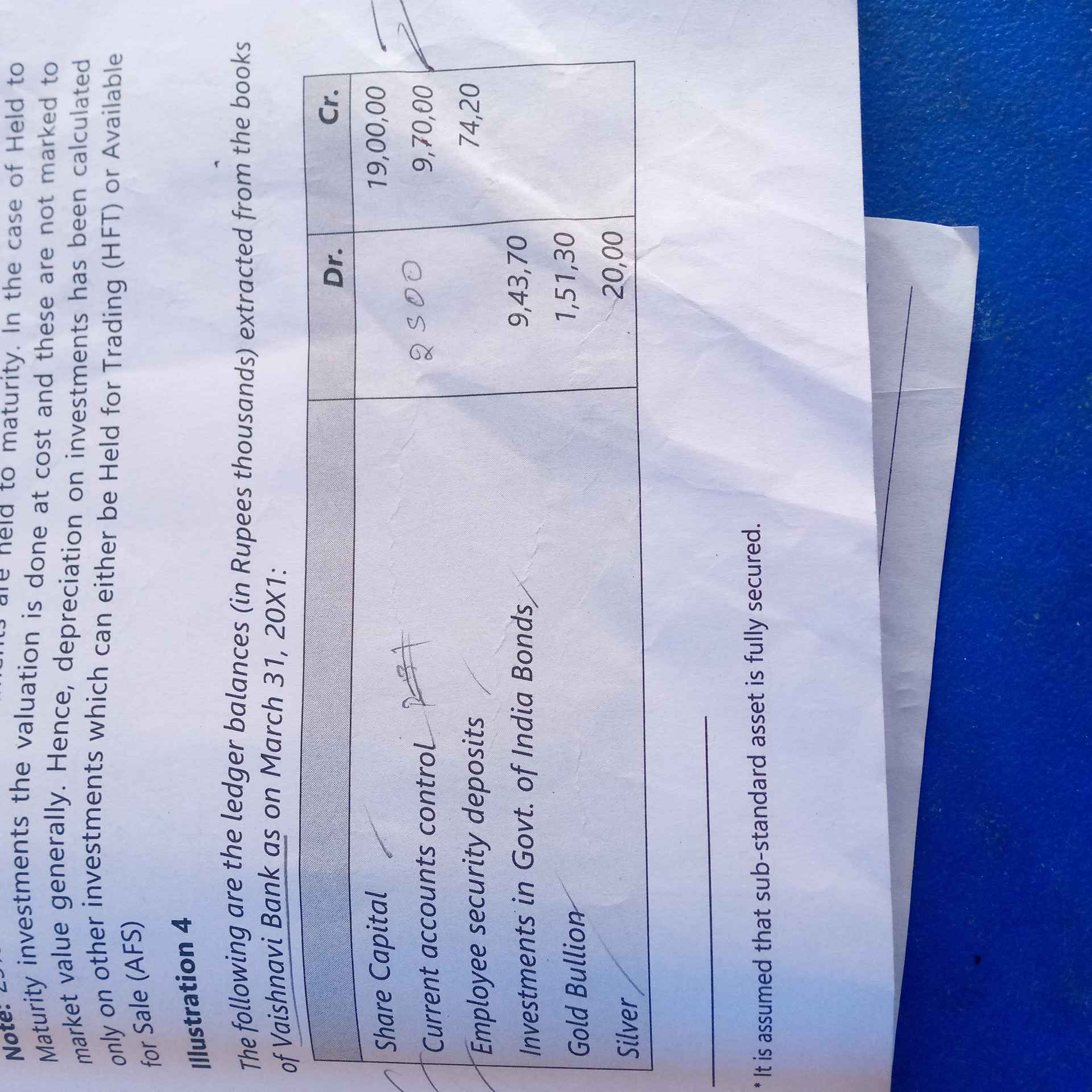

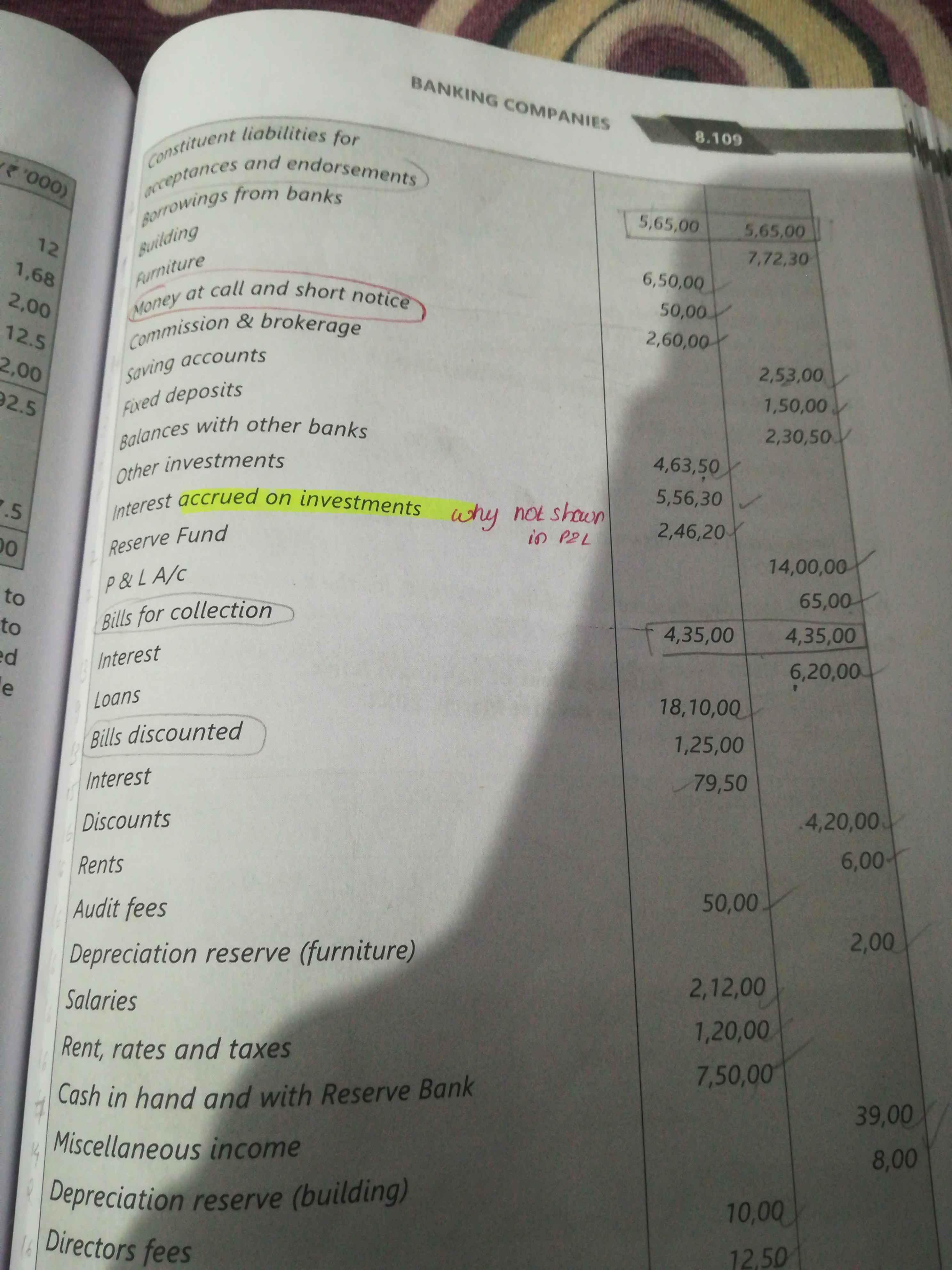

Why interest accrued on investment ,not taken into profit and loss Accounts i.e in schedule 13( why it was included only in other asset)

Answers (13)

Christeena Ambel

Yeah.. I have also marked the same..

I think the only possible chance is ,it is opening accurued income ( then it would be already added in opening profit)

Christeena Ambel

I have marked about 5-6 dbts in this qn.. Don't know even how the cost of assets came

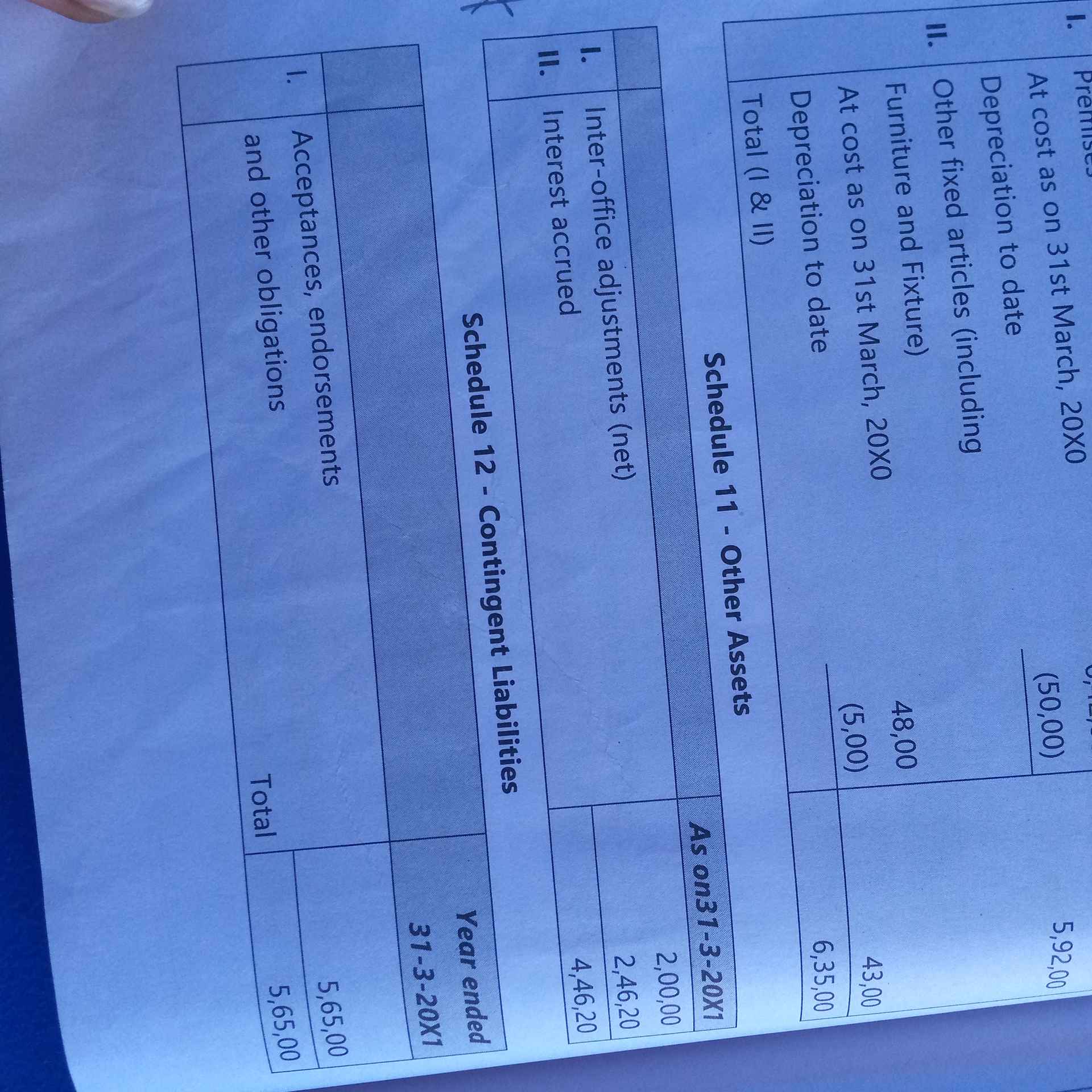

There was provisions on depreciation in trial balance (which means the depreciation are not reduced in assets before this year) so that provisions first cancelled( provisions for depreciation dr to asset) and the current year depreciation reduced Prov of dep for building dr- 8000 To building --------. 8000 After that dep dr- 50000 To buil- 50000 Finally buliding -650000-8000-50000= 592000 Likewise for furniture