Forums

Capital gains sec 50C

Direct Taxation

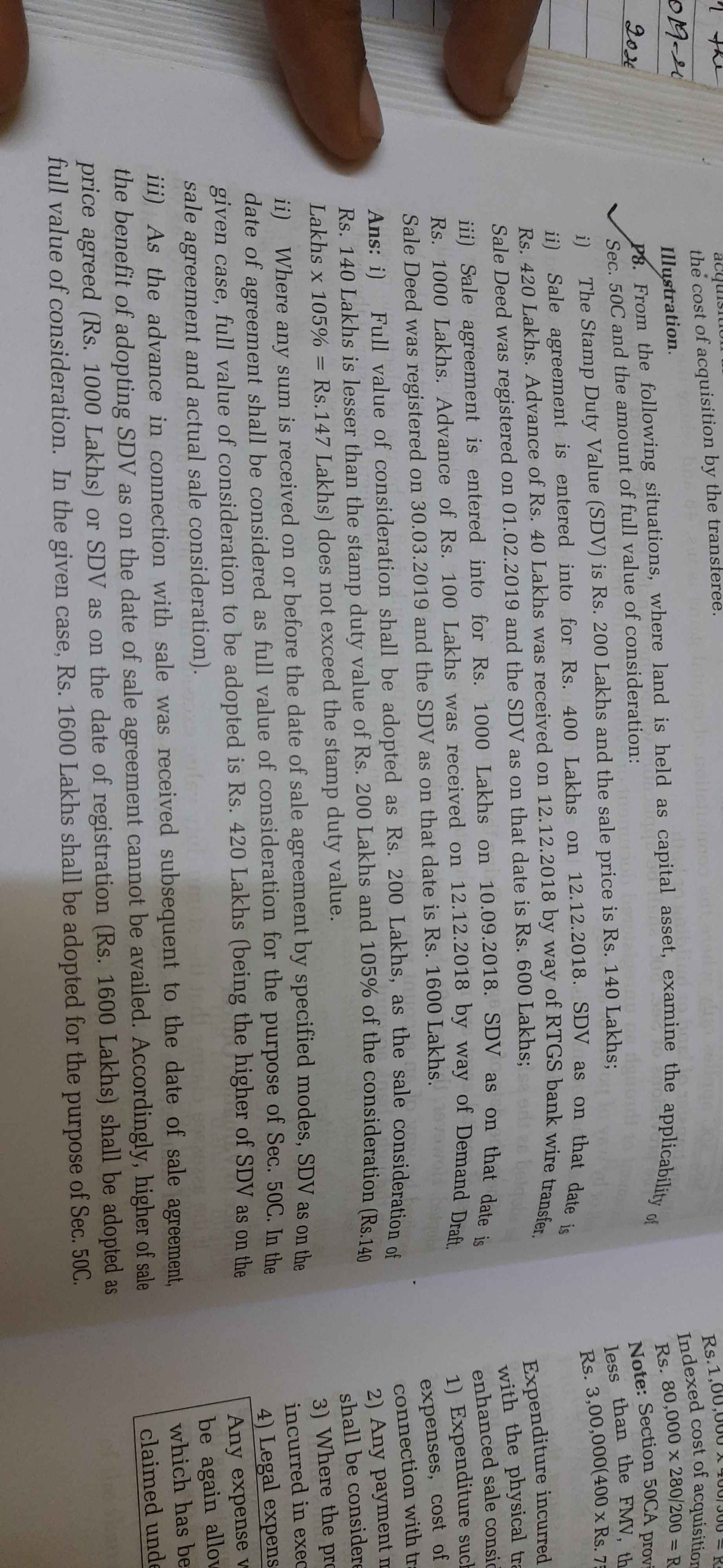

In the attachment in (ii) of the problem where the sales agreement is entered into on a date different from date of registeration, a part of sales consideration is received on or before so the SDV as on the date of agreement is to be taken as sales consideration, the doubt come here since the sales consideration(400Lacs) is not < 105% of the SDV(420lacs) as on the date of agreement Can the actual sale consideration be taken as sale consideration?

Answers (3)