Forums

Capital structure - Arbitrage

Financial Management

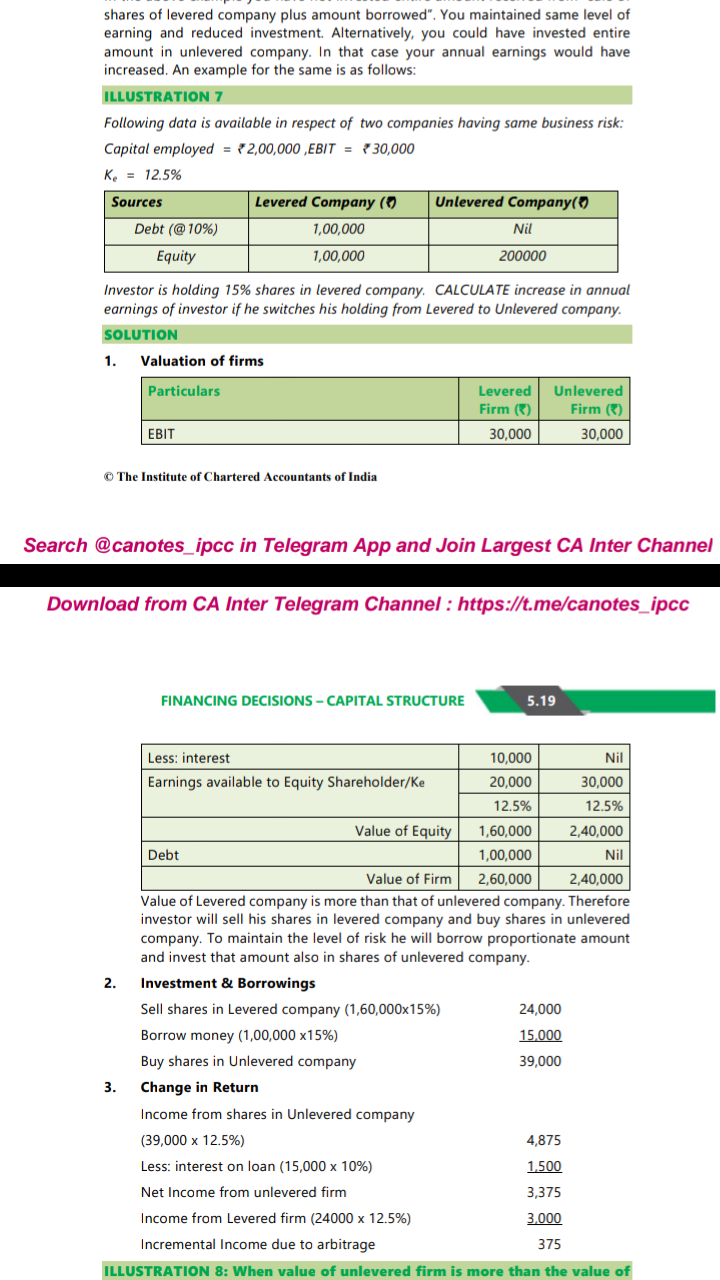

Sir, Is this SM solution regarding Change in return part is correct ? If we calculate Income from levered company, it would be 30000�16.25% = 4875. i.e WKT 39000÷240000=16.25%. Income from levered firm going to be (30000 - 10000)�15% = 3000 Kindly Need clarification !

Answers (5)

Best Answer

Thread Starter

Madhaan SSir, my question is why we are calculating return specifically from "Income from (Shares) of Levered and unlevered firm" and why not from EBIT ? In previous ques we calculated return from EBIT. screenshot of ques attached.

Please read last line of the solution of previous illustration (Ill6) there they clearly state the diff in solutions in both the examples and how both are ok. In ill 6 they invested only a portion of the amount representing in an unlevered firm representing similar return as the investor had in the levered firm. in illustration 7: they invested full amount in unlevered firm. Both ways are correct unless a method is specifically asked in the exam

Sriram Somayajula Admin

Please read last line of the solution of previous illustration (Ill6) there they clearly state the diff in solutions in both the examples and how both are ok. In ill 6 they invested only a portion of the amount representing in an unlevered firm representing similar return as the investor had in the levered firm. in illustration 7: they invested full amount in unlevered firm. Both ways are correct unless a method is specifically asked in the exam

Thankyou so much sir. Although i read those lines, my gut feeling insisted me to clarify this.Thankyou for clarification sir.