Forums

Capital structure

Financial Management

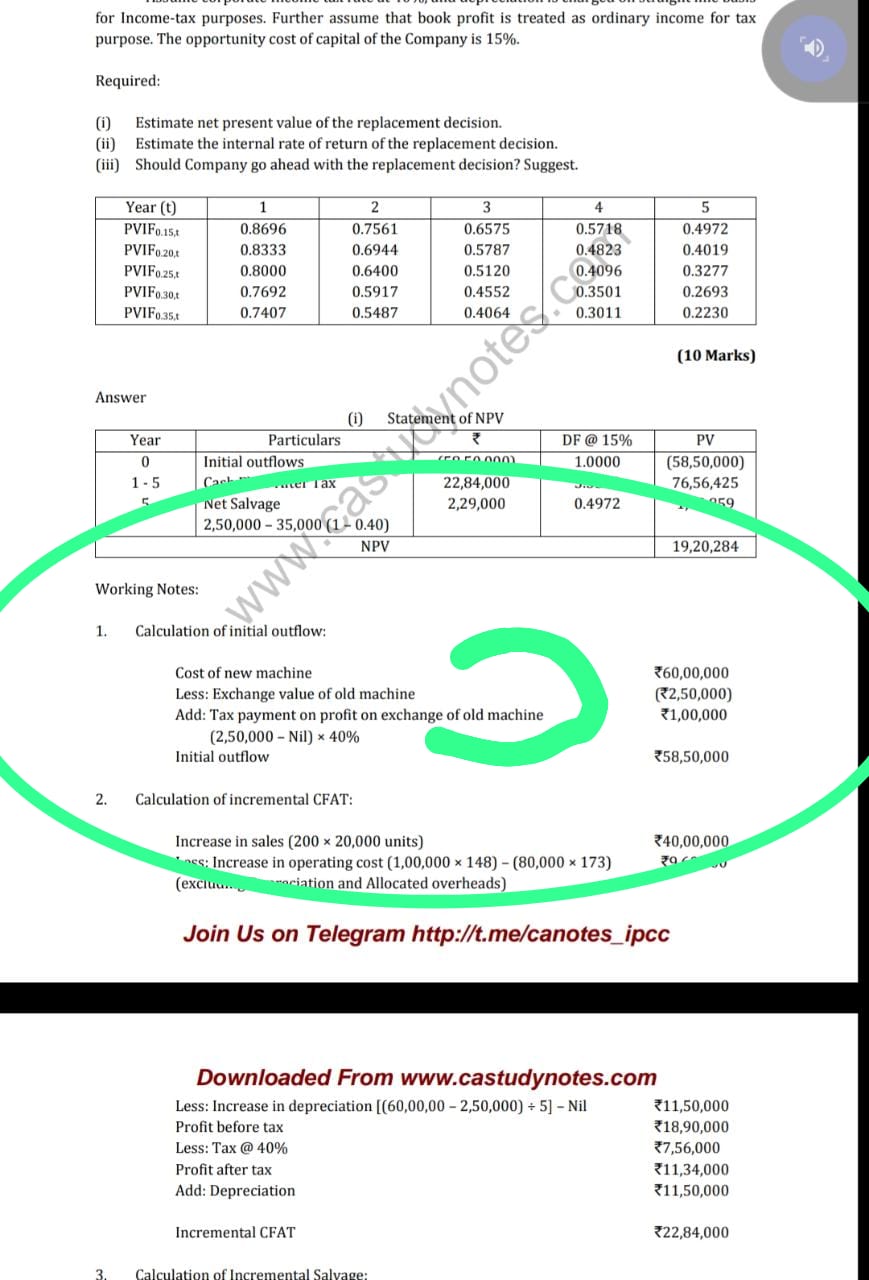

If old machine is exchanged for new one Do we have to consider tax element in outflow Like if old machine is exchanged and the value is 1,00,000 and tax rate is 30% so do we have to consider 30,000 as cash outflow on exchange or not? I saw 2 Sums In one they have not considered tax element but in another they have tax in cash outflow

Answers (1)

Legally speaking whenever there is a transfer cap gains is applicable - however, in the case of the IT Act P&M Block and WDV concept are followed. If information is provided you can deduct tax - else state the assumption clearly that you are not considering tax as more information is not available