Forums

Capital structure

Financial Management

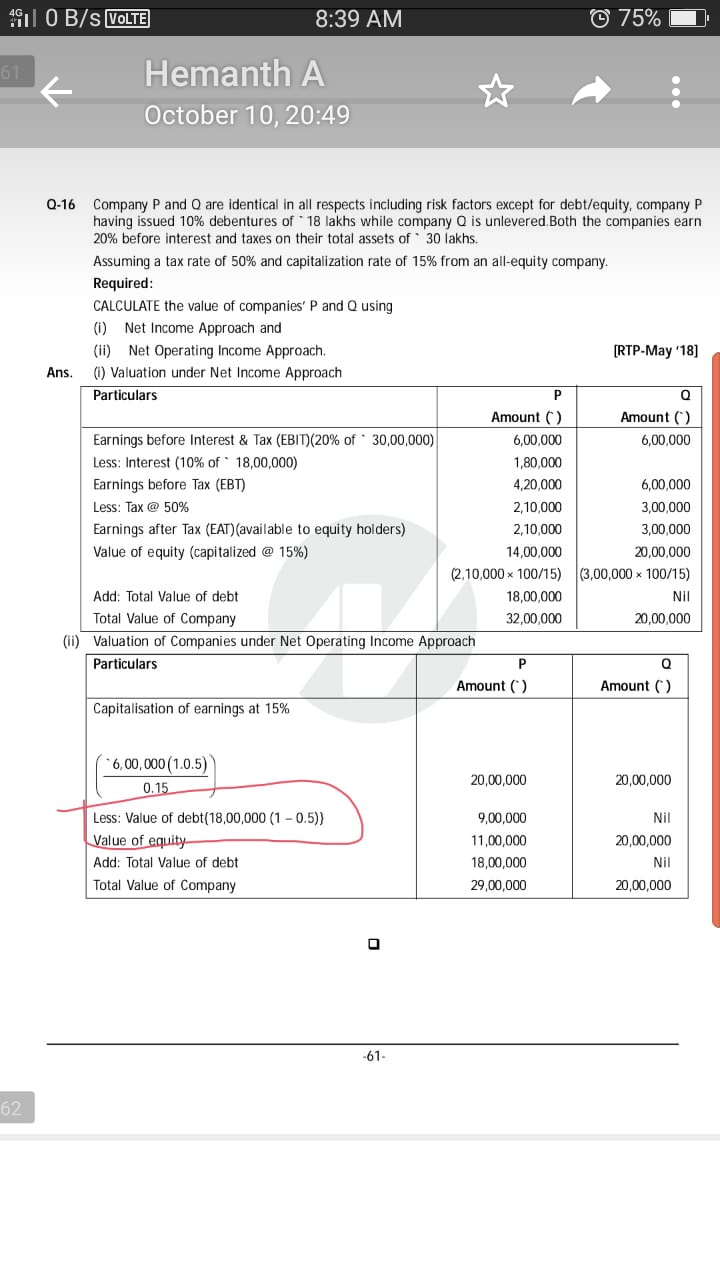

Why he has deducted value of debt net off tax

Answers (7)

Thread Starter

Satya ShashankSorry this is the image

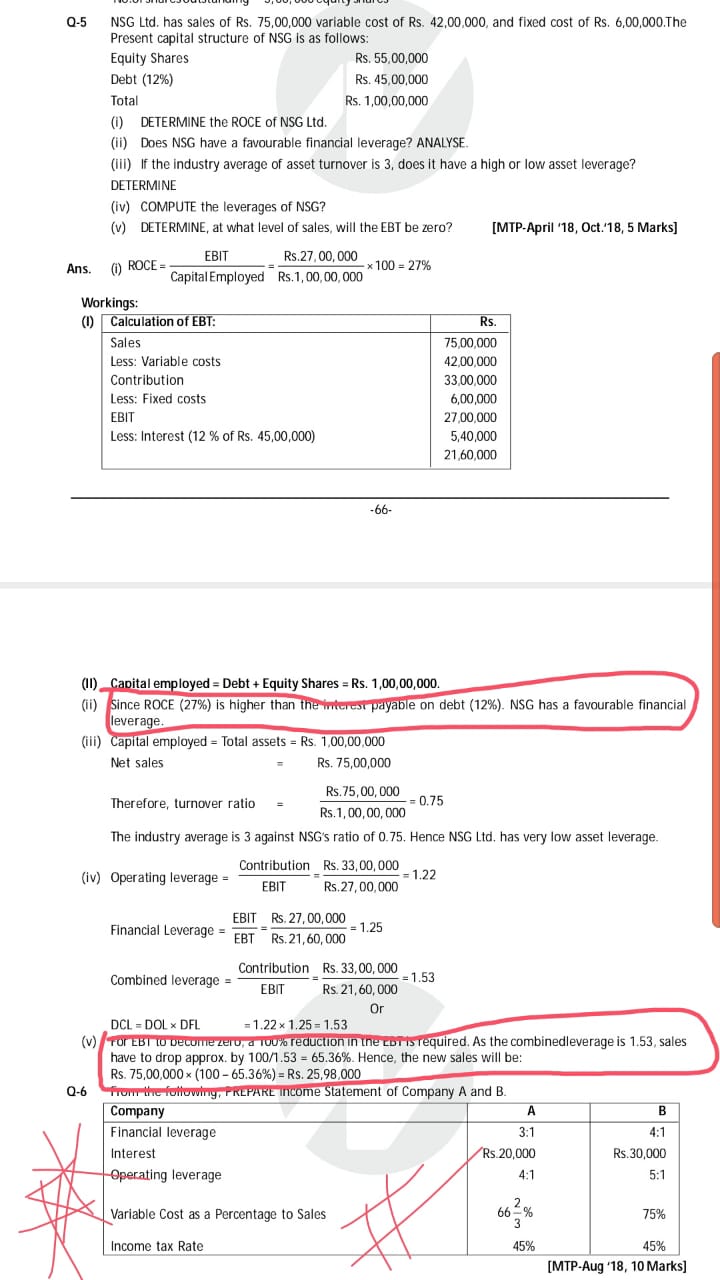

This is from RTP May 2018 - the solution does not appear to be correct. Under Net operating income approach approach - value of a frim will not change due to capital structure as lower cost of debt will be offset by a higher cost of equity and when you capitalize equity earnings and add value of debt, the total value remains the same - that should be the ideal answer

Sriram Somayajula Admin

This is from RTP May 2018 - the solution does not appear to be correct. Under Net operating income approach approach - value of a frim will not change due to capital structure as lower cost of debt will be offset by a higher cost of equity and when you capitalize equity earnings and add value of debt, the total value remains the same - that should be the ideal answer

So value of the firm will remain same in both NI and NOI approach, is that so?

Thread Starter

Satya ShashankAttachment is not opening

For attachment refer page 10 last para of link below https://resource.cdn.icai.org/56015bosinter45376-p8-seca-cp5.pdf Value of all equity firm will be Rs.20 Lacs and same will be the value for a levered frim under NOI approach. Part 2 of the answer is incorrect - correct answer is ( 20 lacs P & 20 lacs Q). Part 1 of solution is correct ( 32 lacs & 20 lacs) -