Forums

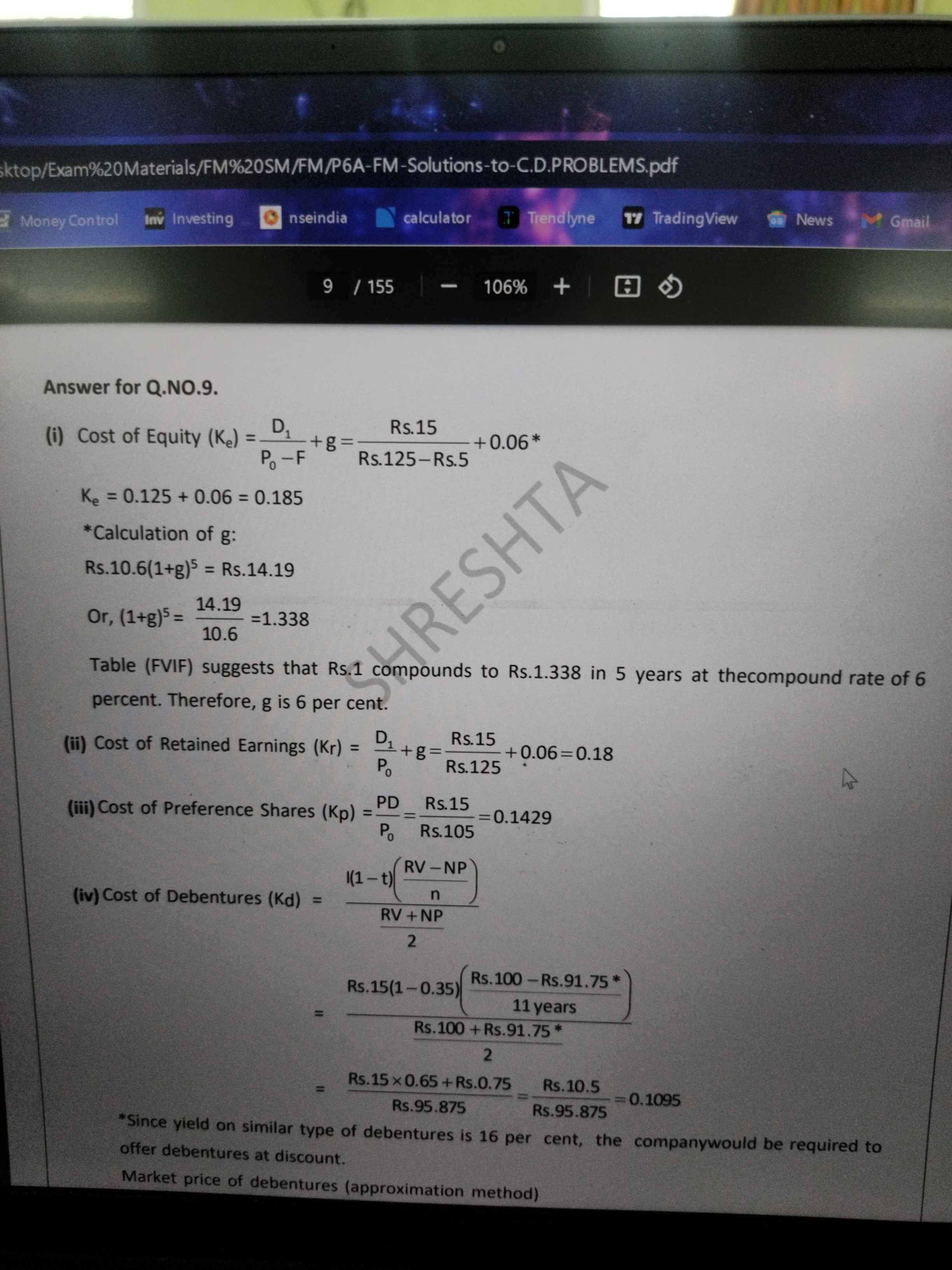

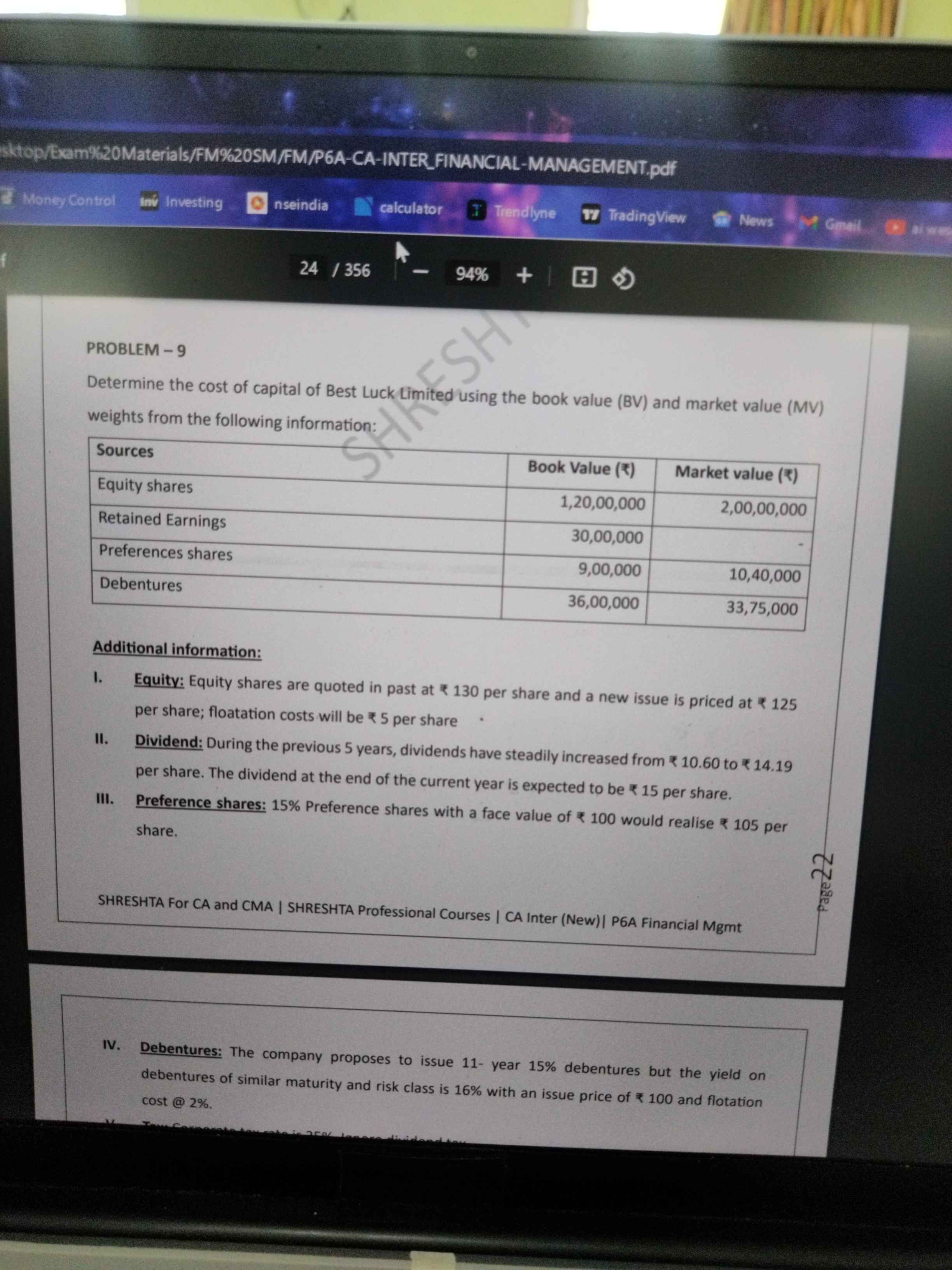

Cost of capital

Financial Management

For calculating cost of equity and retained earnings why is ₹130 not used and ₹125 being used?

Answers (2)

Ideally for irredeemable securities like Equity Shares/Irredeemable Preference Shares/Irredeemable Debentures MV is more preferred, in case the question is specifically about WACC based on MV But when the question is a combination of computation of BV & MV, to avoid the confusion of using different costs, as weights any ways have to be inevitably different for BV & MV, & also to differentiate between Ke & Kr, Ke is considered based on (issue price - floatation cost) & Kre is considered on issue price ignoring the floatation cost