Forums

Cost of captial

Financial Management

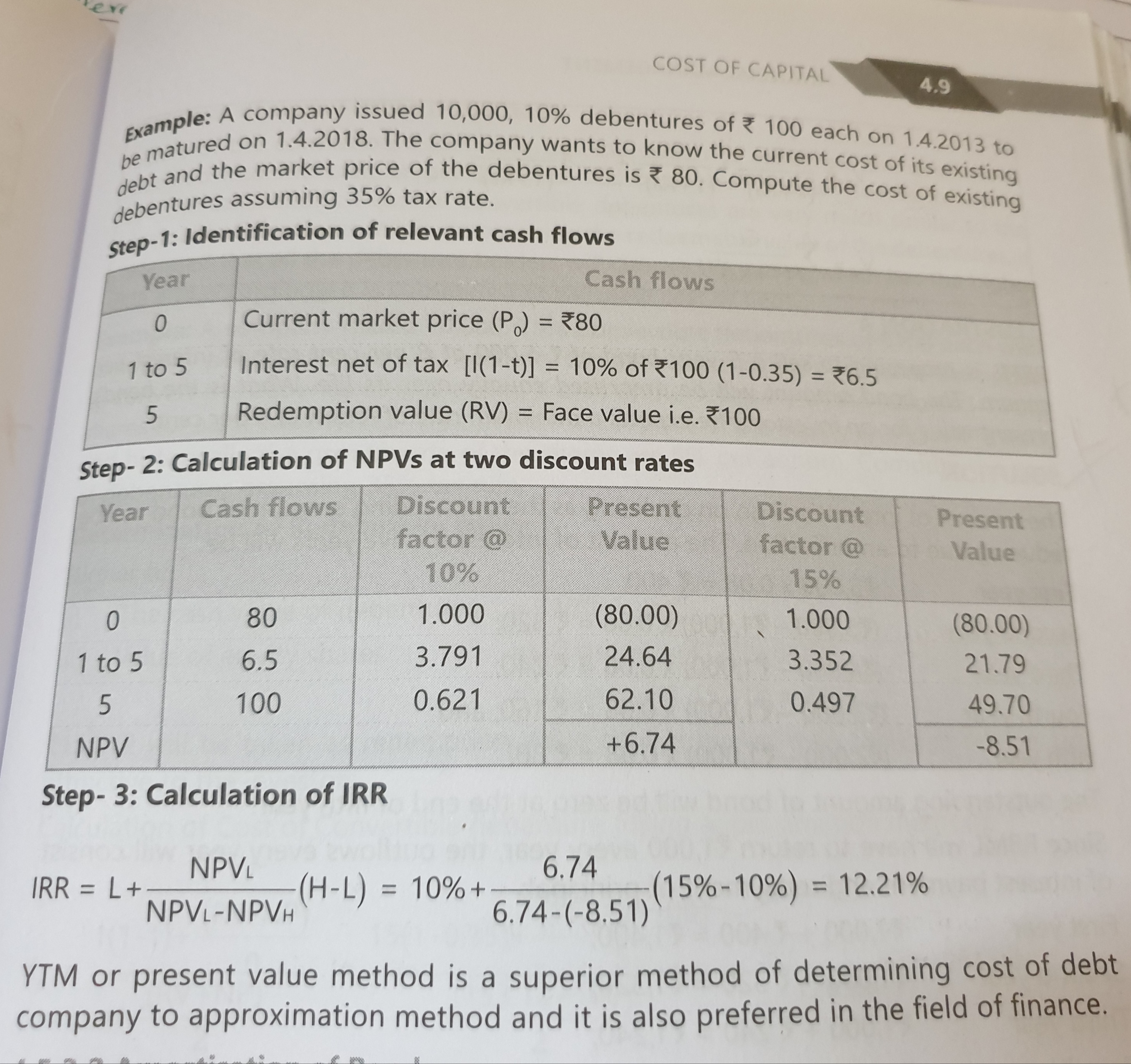

In YTM apporach, in the example (given in the pic) Why do we take 80 as cash outflow and balance interest as cash inflow, isn't it actually the opposite.Since when we issue the debentures we are getting money and therefore cash inflow and the interest are to be paid which results in cash outflow. So how come the opposite happen. Can u please explain this ?

Answers (4)

Best Answer

Thread Starter

Swathi KrishnaSo in exam should we write from investor's perspective

Cost of capital does not change whether it is investor perspective or company perspective. A transaction will happen when a buyer is willing to pay a price that the seller is willing to sell at. Whether you compute A X B or B x A answer is same. Which ever perspective you choose, please follow the logic through the problem.