Forums

Credit note

Indirect Taxation

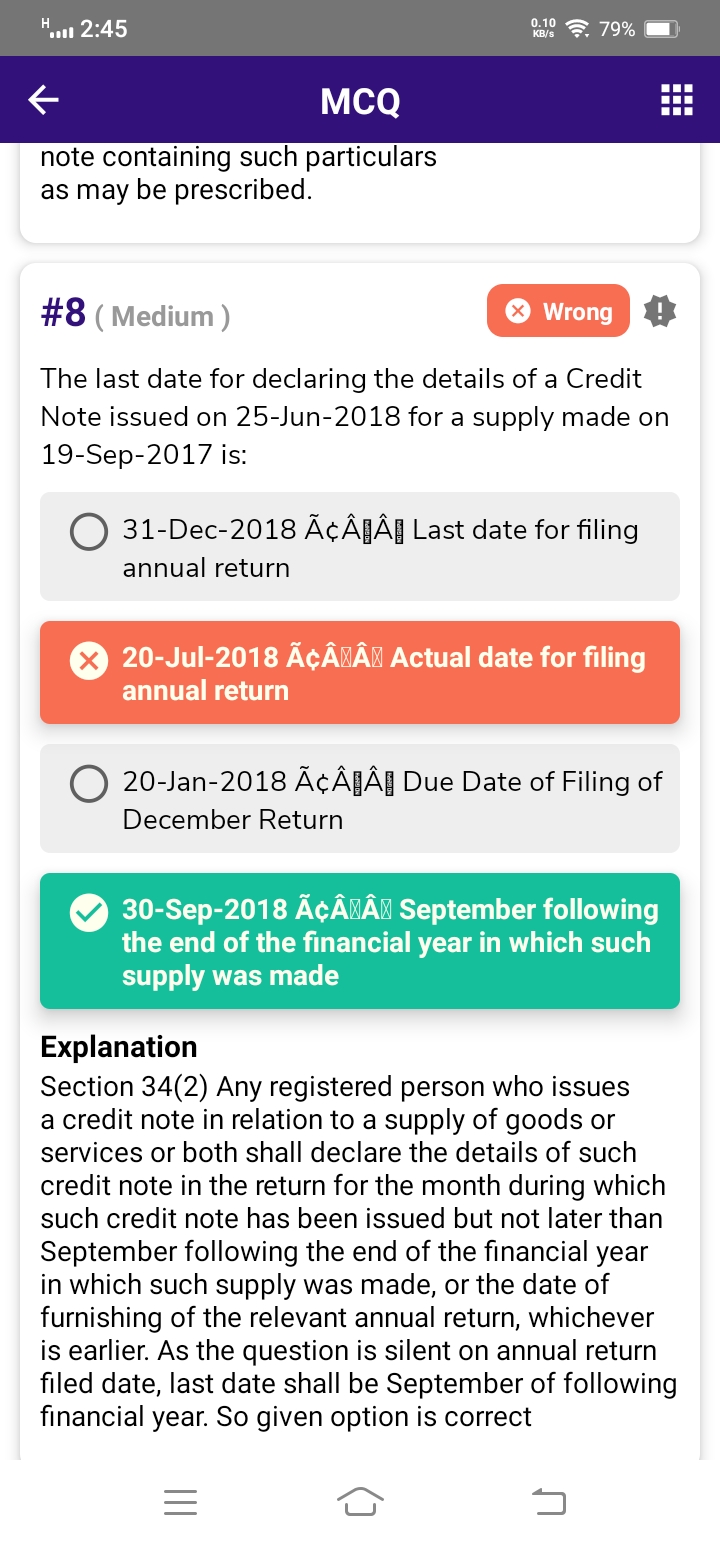

Can anyone explain how option D

Answers (6)

Best Answer

See as you know the time limit for credit note . the question says that we declared a credit note on 25 June 2018 for a supply of sept 2017 Only that information is given..( no annual return date is given) to how can u say that annual return is filed ? Bcz option is provided, it is only to misguide you..( option is not a question part) Actually the answer is 30 sept which is right

Manav Dixit

See time issue for credit note is September following end of fy in which supply is made or date of Annual return (w.e.e) Here Annual return date is not given so we can take 30th September as a due dare

But they have given July as Actual date of Annual return,which is earlier.But my answer is wrong .How.?