Forums

Derivatives-options

AFM

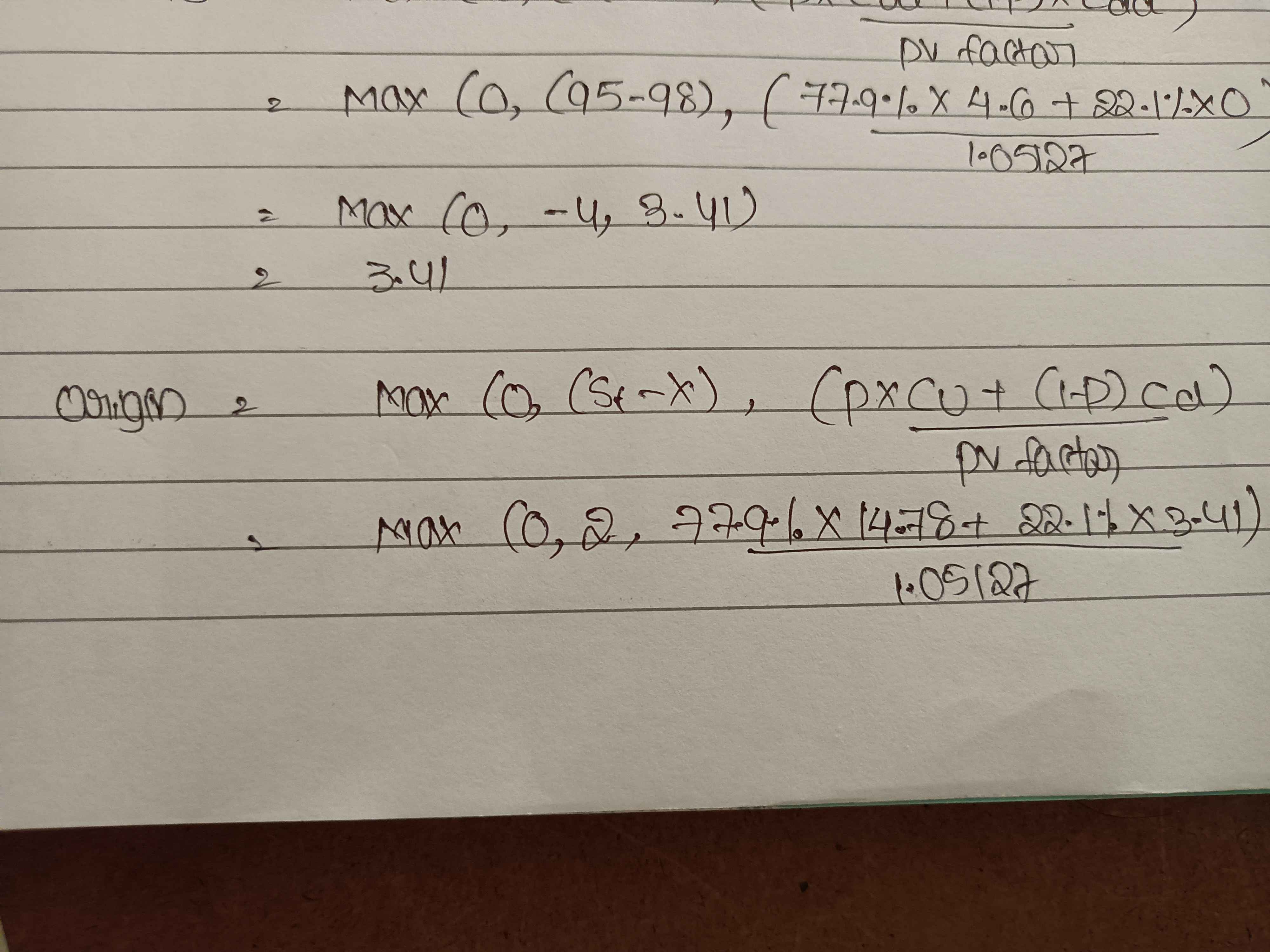

Can I calculate option price using this formulae at origin 👇

Answers (4)

Best Answer

Thread Starter

Srikanth Srimath Tirumala PeddintiSir...Using this formula at origin is inappropriate. I understood that... Can we use the same kind of formulae in determining the American call option price at node Cu & Cd in two sub periods binomial tree?

Yes absolutely. we have used that way only in our problems. Do go through American call option problems where this has been discussed

No. Max ( S-K,0) is the formula that gives us the value of the option on the date of maturity The other formula you used in the equation is based on a risk-neutral model where the result is the same as the binomial model and is used to find out the value of an option at any time period before maturity (with only two possible outcomes with a clear understanding of probabilities for both outcomes) How can you combine both?