Forums

Doubt in May 2018- Non-Integrated Reconcilation

Costing

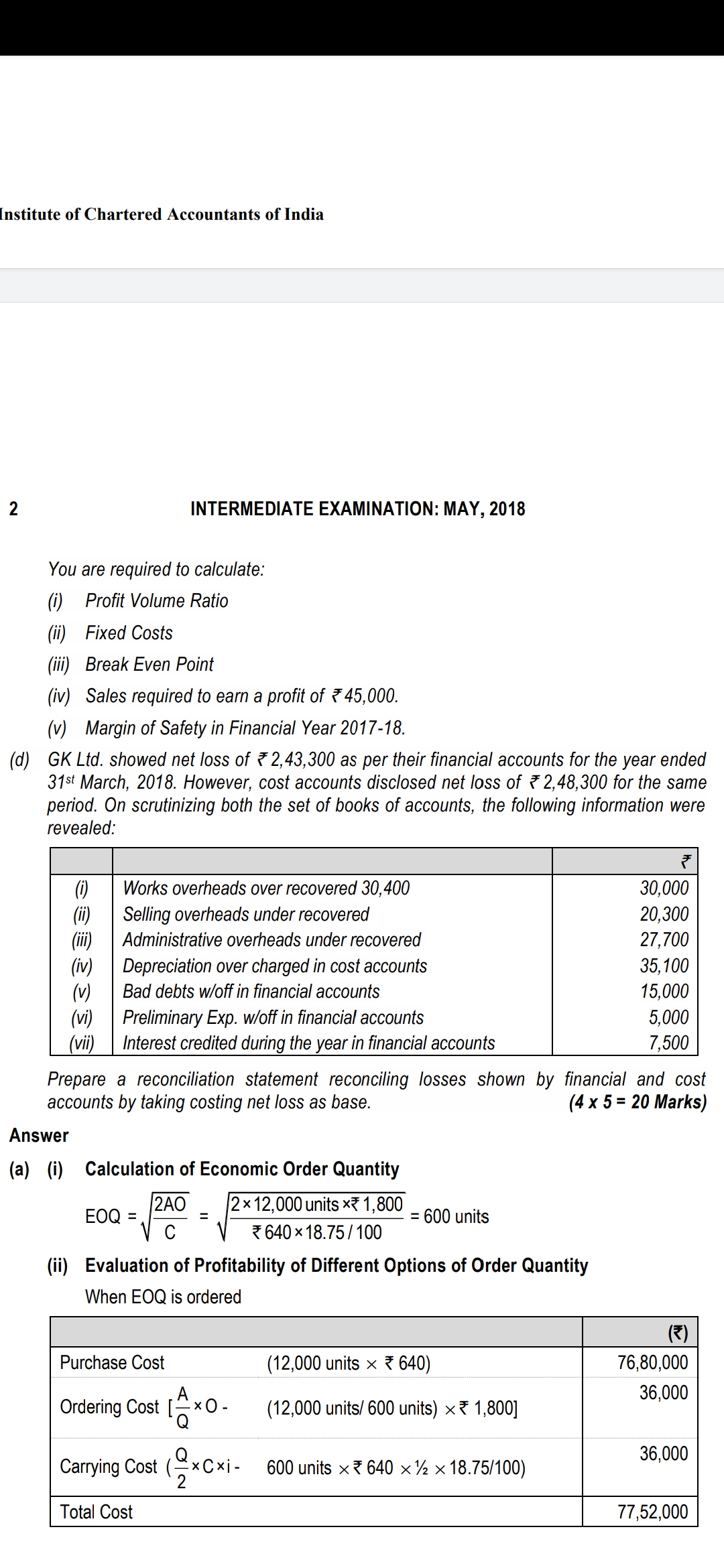

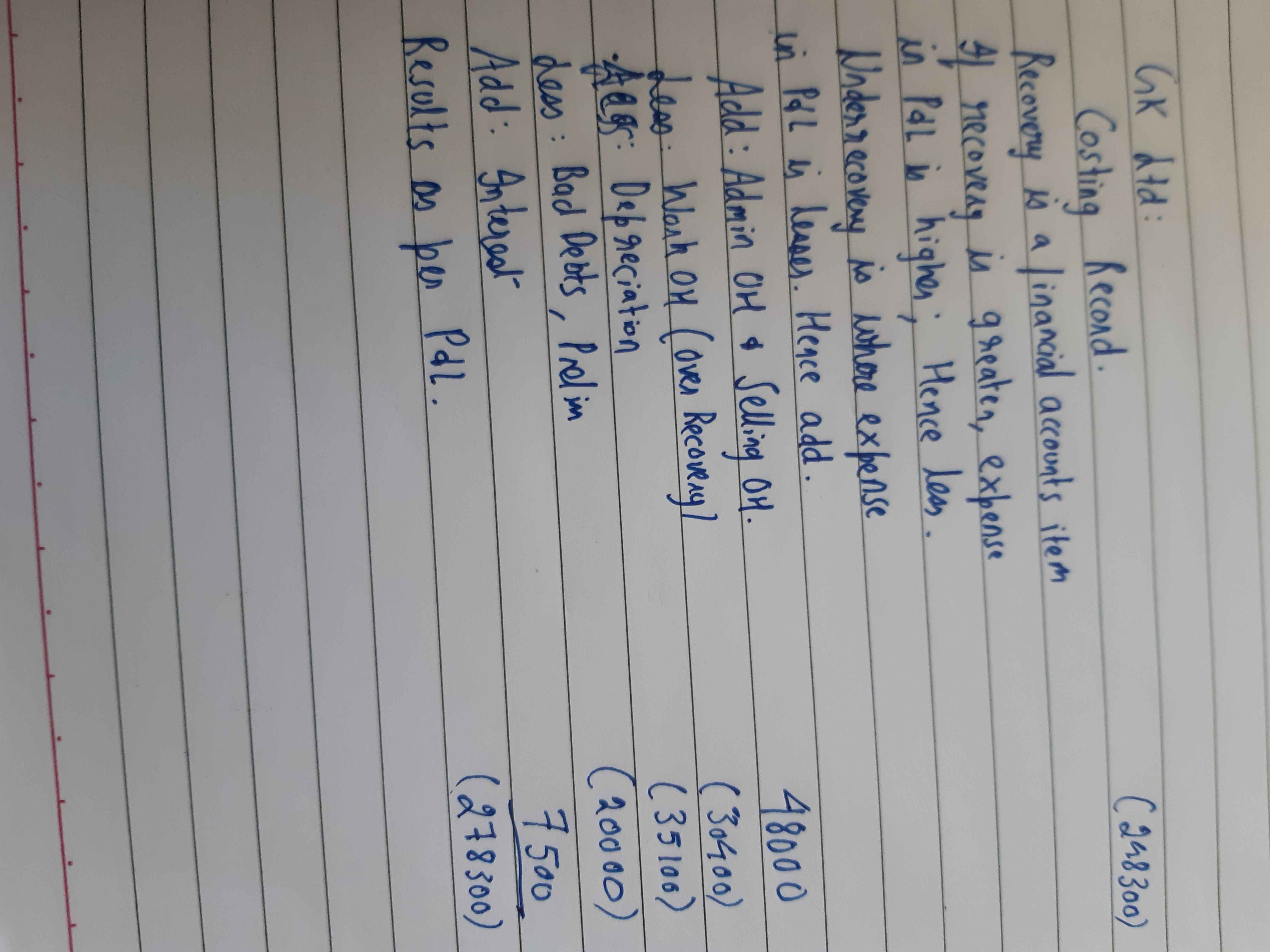

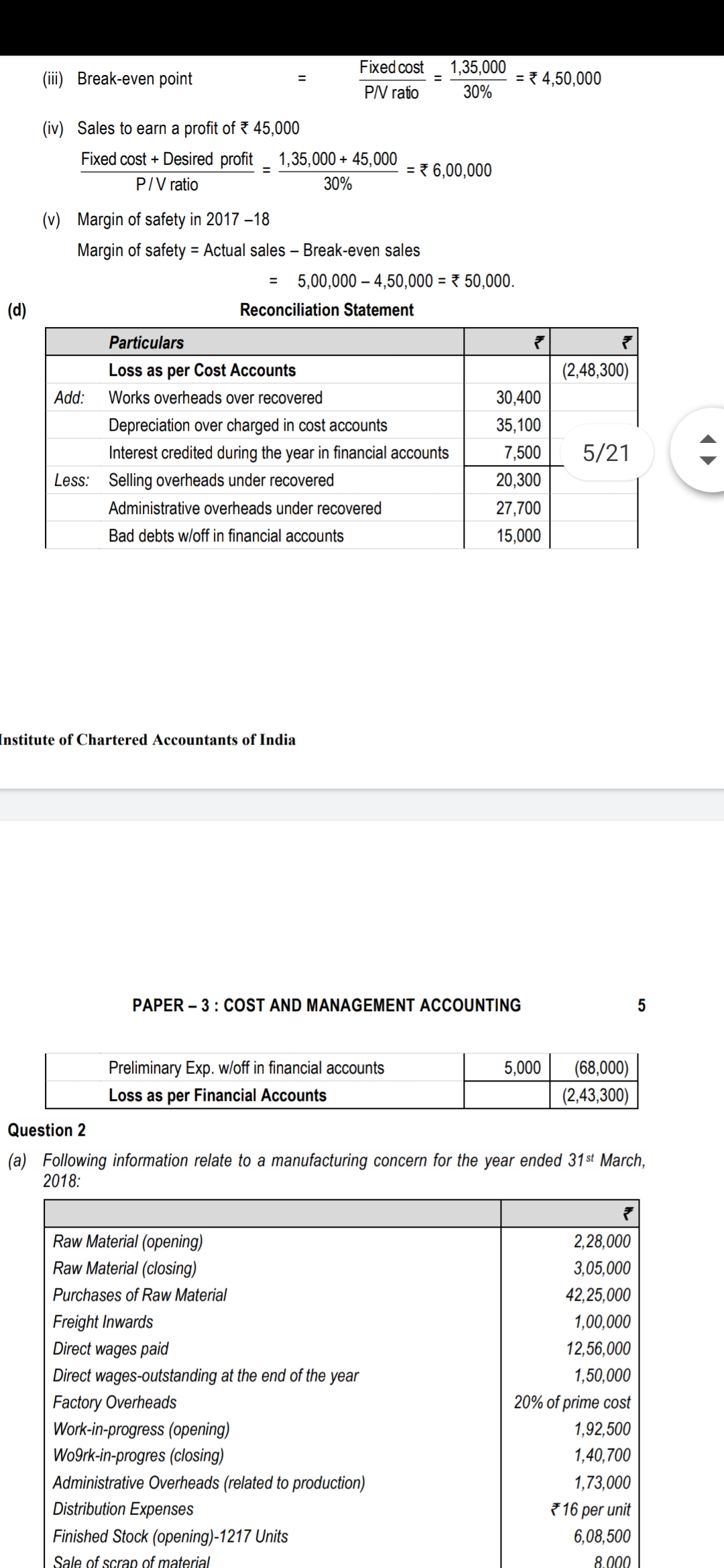

I have solved question 1 (d) pertaining to GK Ltd and have explained my rational in my answer too. I'm getting a big difference from the actual answer. Can someone please explain the logic in the question and where I'm going wrong? Question, my answer and the answer key's answer are uploaded- I don't understand the logic of the answer key very clearly.

Answers (1)

1. Works overheads have been charged more in cost accounts than those in financial accounts. This means profit as shown by the cost accounts is less than the profit as shown by the financial accounts by Rs. 30400 (the amount of over-recovery). Since profit as per cost accounts has been taken as the base, the amount of Rs. 30400 should be added to arrive at the profit as shown by the financial accounts. 2. Selling and administration overheads are under recovered so they are to be subtracted (applying the same logic as in the above point) to arrive at the profit as shown by the financial accounts.