Forums

Exemption

Indirect Taxation

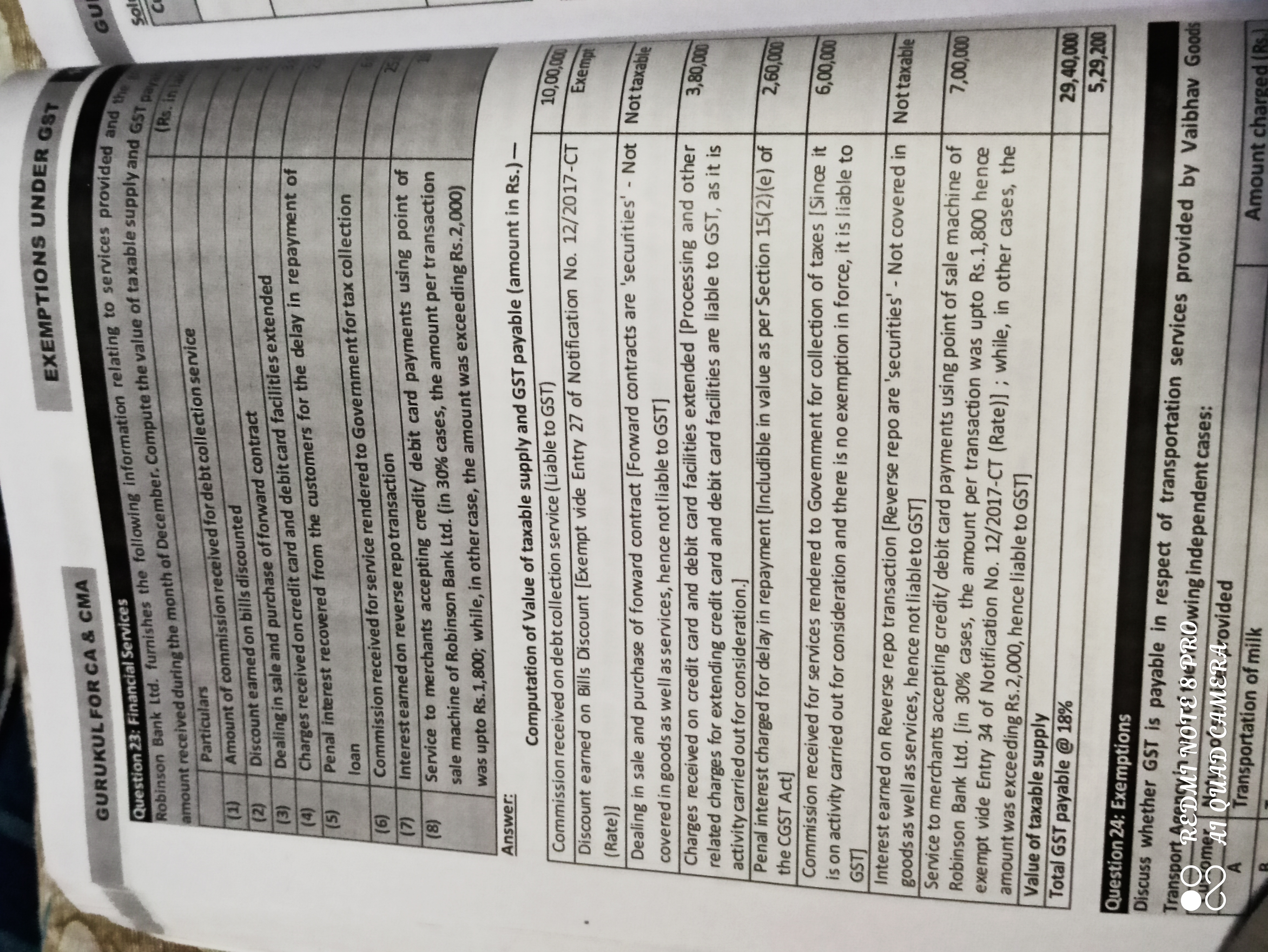

Sir in exemptions discount earned on discounting of bills of exchange is taxable but here they said exempt?

Answers (4)

Discounting of invoices or cheques falls within the meaning of â??services by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discountâ??. Such discounting is exempt from payment of GST, as such discounting is nothing but a manner of extending a credit facility or a loan. However, if some service charges or service fees or documentation fees or broking charges or such like fees or charges are charged, the same would be a consideration for supply of service and chargeable to GST.