Forums

Head

Direct Taxation

One doing business of builder means selling buildings and land and also allotted for rent. In his hand his own 10 Properties. He sold 6 Properties, due to some market conditions 4 properties remain unsold and the remaining 4 given for rent. In Which heads, these incomes are charged. ?

Answers (11)

Best Answer

Thread Starter

Balamurali Unnithan M SBoth come under PGBP Head. I'm right Ji.?

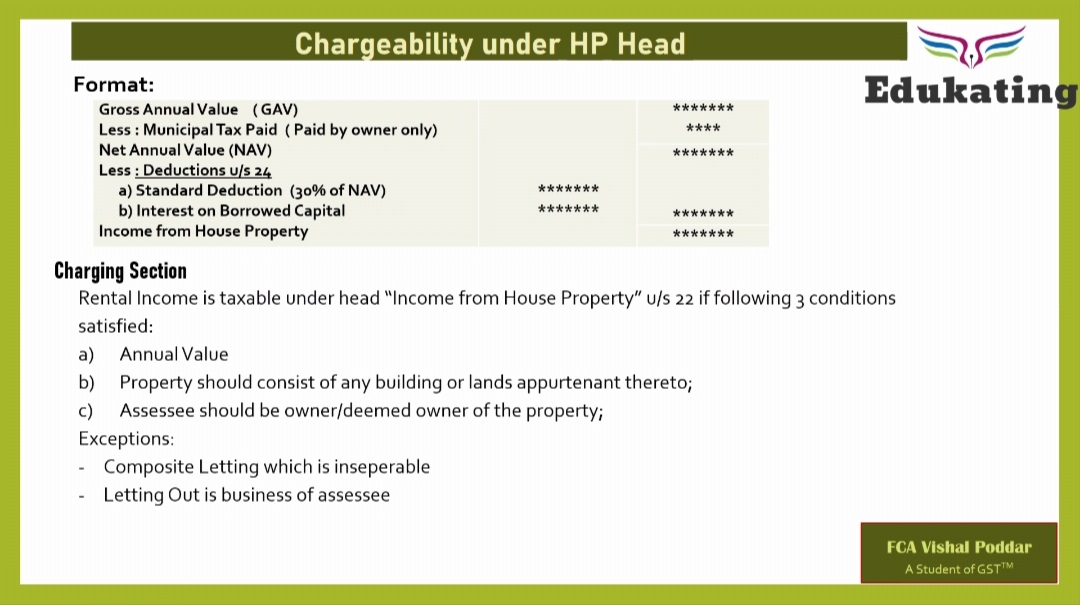

Income from let out - House property. But there have been case laws in past where courts have allowed it under PGBP

Can you put your opinion on the scenario I asked? I mention below once. My understanding, It comes under PGBP Head. Because he is a builder and his business is let outing properties. Your opinion is no, what's the reason. Question below "One doing business of builder means selling buildings and land and also allotted for rent. In his hand his own 10 Properties. He sold 6 Properties, due to some market conditions 4 properties remain unsold and the remaining 4 given for rent. In Which heads, these incomes are charged. ?"

CA Suraj Lakhotia Admin

Not sure about the source. As I mentioned earlier that some cases court have held that such income can be considered under PGBP

Difficult to believe, it's wrong. He is also a well-known faculty like Indigo Learn Team.

Thread Starter

Balamurali Unnithan M SDifficult to believe, it's wrong. He is also a well-known faculty like Indigo Learn Team.

I have not told that the author is wrong. You can read the various case laws in the attached link. https://www.bangaloreicai.org/downloads/Vijay.pdf