Forums

INSURANCE CLAIMS

Accountancy

Which expenses of these following expenses are treated as insured standing charges expenses

Answers (13)

CA Suraj Lakhotia Admin

It depends on the contract between the Insurer and Insured. The insurance contract would define what are the charges which are insured.

Sir, in some questions they are including selling expenses in some other not selling expenses how can we estimate

Thread Starter

subramanyam yendakuarthiSir, in some questions they are including selling expenses in some other not selling expenses how can we estimate

Pls share the question. The wordings of question will help us understand.

CA Suraj Lakhotia Admin

Pls share the question. The wordings of question will help us understand.

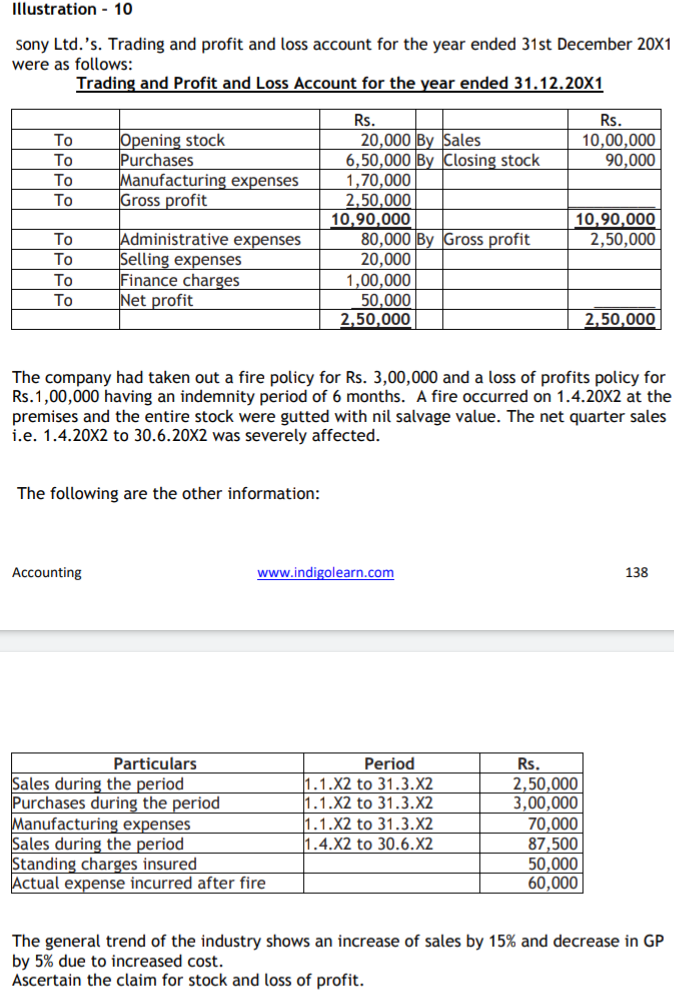

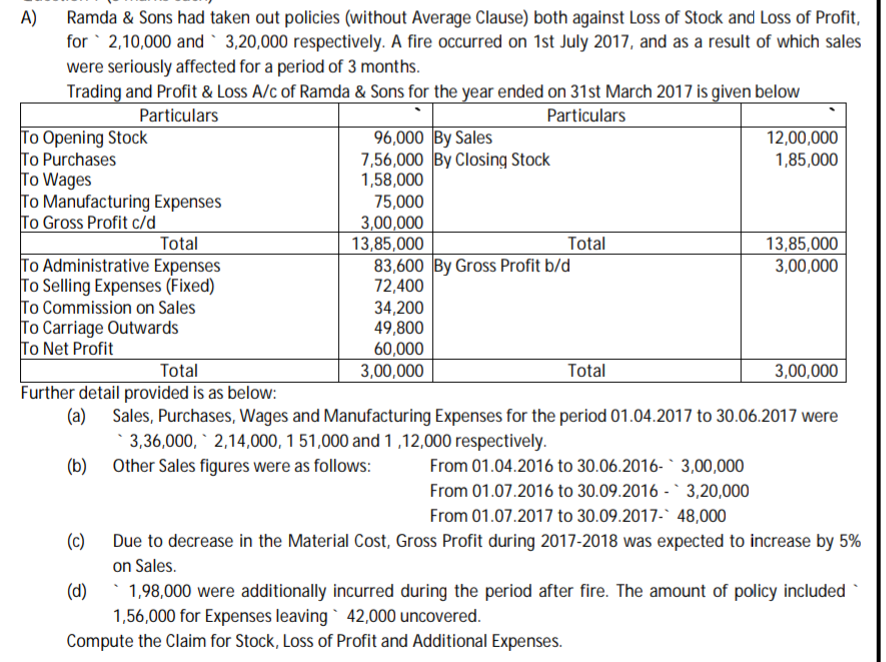

Sir, In Ramda and sons they included selling expenses where as Sony ltd they doesn't use selling expenses

Thread Starter

subramanyam yendakuarthiSir, In Ramda and sons they included selling expenses where as Sony ltd they doesn't use selling expenses

The question gives following towards standing charges insured. Ramda & Sons - The policy states that 156,000 is insured. Sony limited - 50,000 Is this what your doubt is?

Thread Starter

subramanyam yendakuarthiWhile calculating gp which are standing charges are taken

Gross Profit = Net profit + Insured Standing Charges.

Star Ca

May be his question is in above question while calculating gross profit why selling expenses are not considered. Where in some other questions they are considering selling expenses also as insured standing charges

You have to consider insured standing charges which is given in question. Please note that the GP for additional expenses is different from normal GP and this has been extensively covered in class.