Forums

Income from ho

Direct Taxation

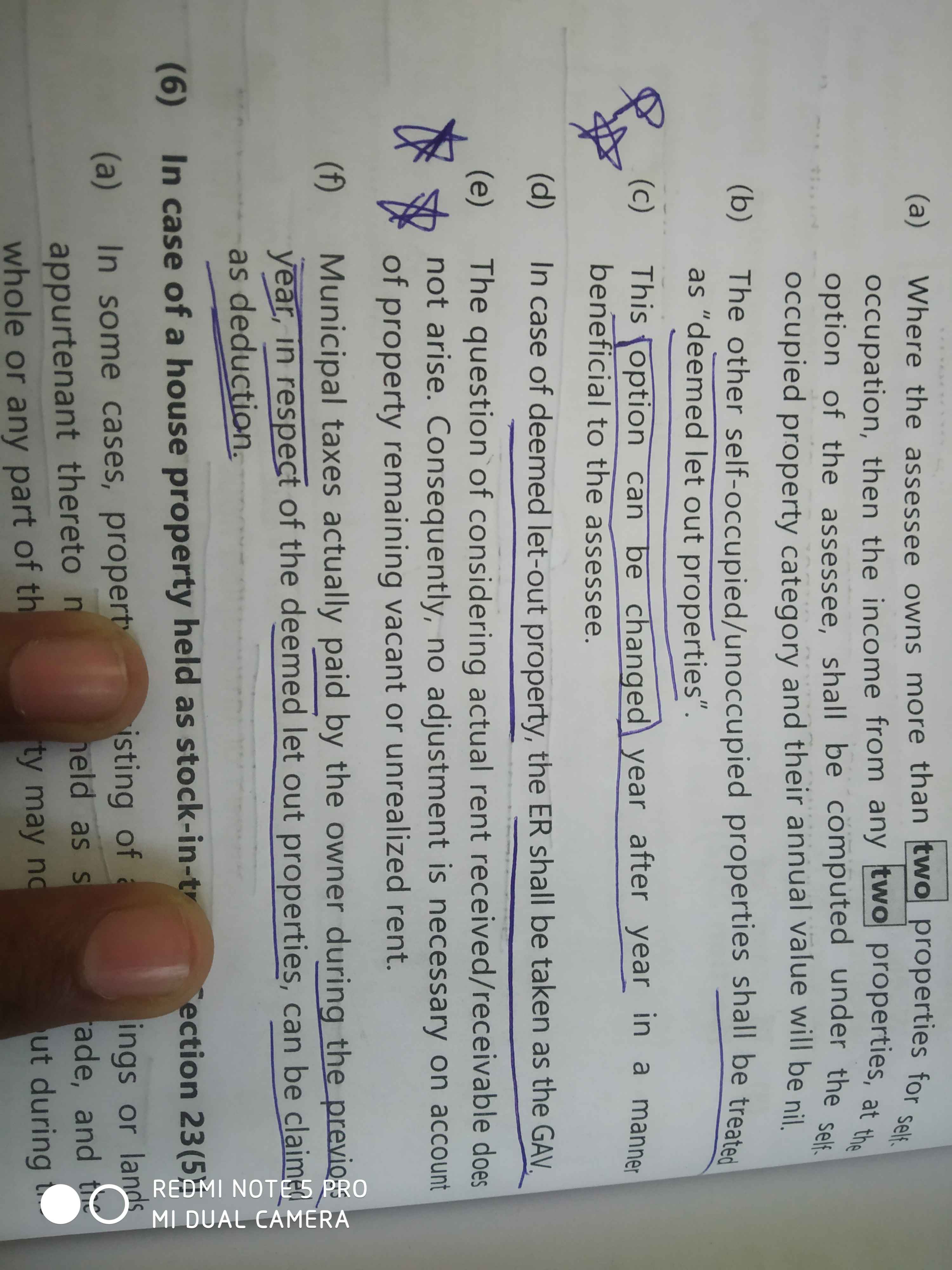

If the property is vacant for a whole year& it is not self-occupied since already 2 propert has been considered as self-occupied then GAV is NIL due to actul rent is less than ER since owing to loss of vaccancy

Answers (7)

Yoga Vishnu

Calculate IFHP as if the house had been let out. If actual rent is lower than expected rent owing to vacancy, then actual rent is GAV.

If property is vacant for whole year then?

Third house property is treated as deemed let out property. 1. Calculate reasonable expected rent. 2. Actual rent is NIL. Actual rent is less than reasonably expected rent not because of vacancy. Because, even though the property is not vacant, actual rent is zero as it is self occupied. So, in this situation, take reasonably expected rent as GAV. If let out property is vacant (not because of deemed let out) for whole year, then take GAV as Zero.