Forums

Ind AS 21

Financial Reporting

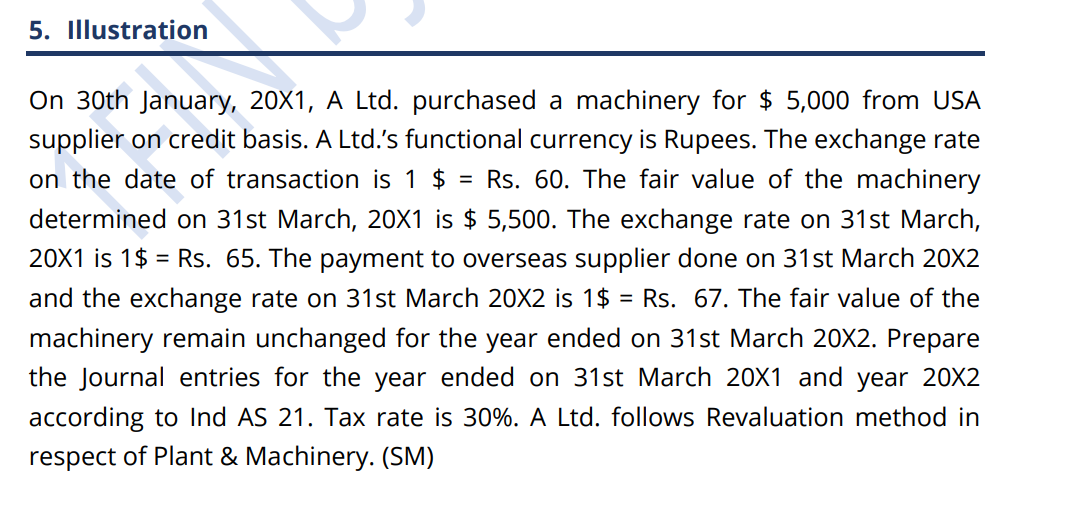

Hello Sir, In this problem, for the year 20X2 Revalued value remains same... And for non monetary items, we convert the amount as on the date of revaluation if revaluation model is followed. Here, the difference is value is only due to difference in exchange rates.. Why do we still adjust it in the balance sheet at 31.3.X2. Is it assumed revaluation is done on 31.3.X2? Will there be no adjustment if nothing about revaluation is mentioned? If we have to adjust, how is it different from the treatment of monetary assets? Video Details Ind AS - CA Final Ind AS 21 The effect of changes in Foreign Exchange Rates 10. Illustration 5

Answers (2)

Best Answer

In case revaluation model is followed as per Ind AS 16, we determine the fair value on date of revaluation (say year end). Now if we have computed value in $ terms on a particular date, we need to convert $ value using the exchange rate on that date. Think of it like initial measurement where we use exchange rate to convert.

CA Suraj Lakhotia Admin

In case revaluation model is followed as per Ind AS 16, we determine the fair value on date of revaluation (say year end). Now if we have computed value in $ terms on a particular date, we need to convert $ value using the exchange rate on that date. Think of it like initial measurement where we use exchange rate to convert.

Okay sir, Understood. Thank you so much sir