Forums

Inventory

Accountancy

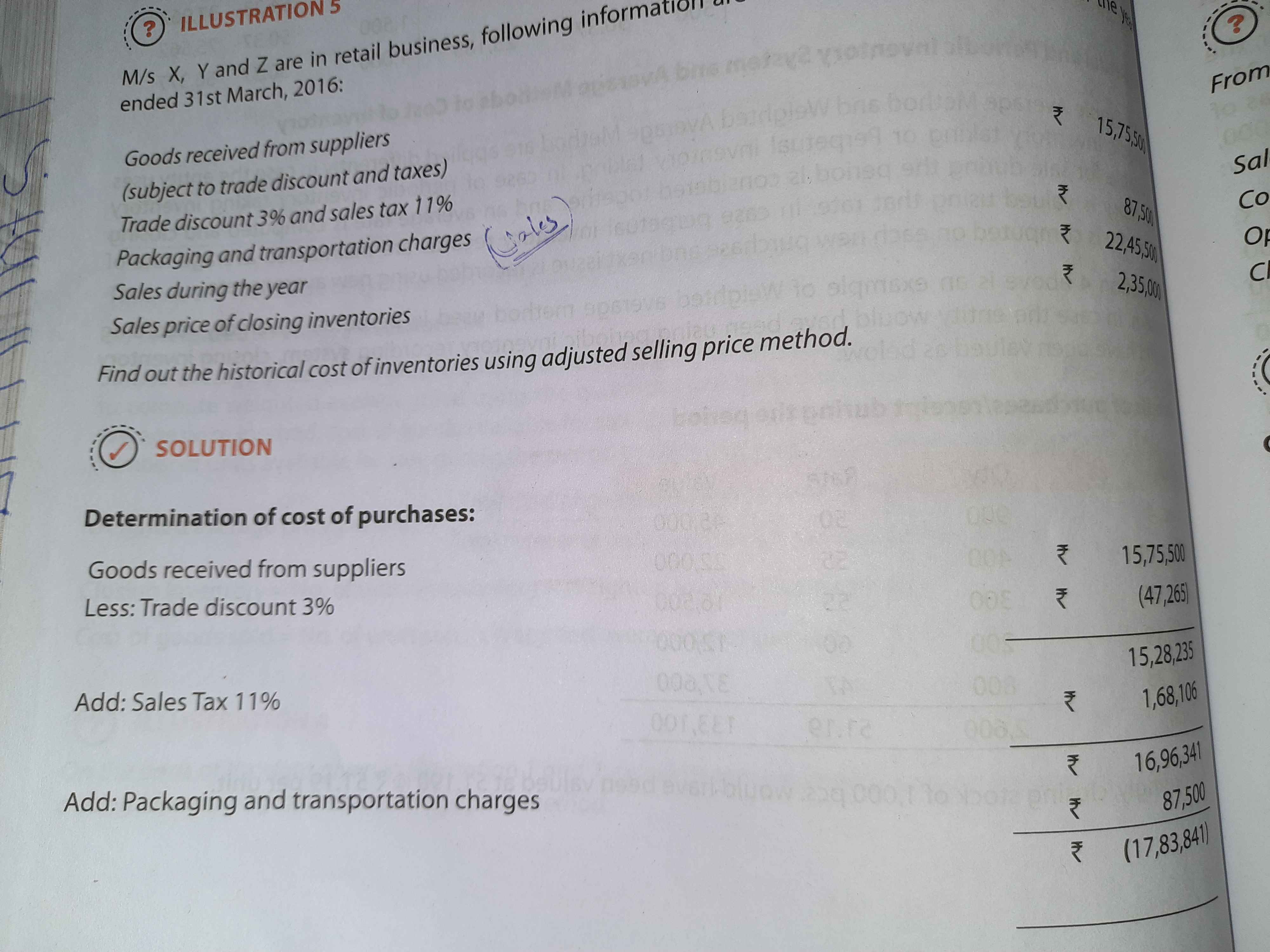

Sales tax is not allowed to cost of inventory and also packing and transporting charges should not be included in the cost of invt as they do not include in other cost

Answers (1)

When you purchase goods, sales tax paid (currently GST) will form part of cost of inventory if credit of tax is not allowed. Also the cost incurred in packaging and transportation (on purchased goods) to bring the inventory to your location would be a cost of inventory.