Forums

Investment Accounts

Accountancy

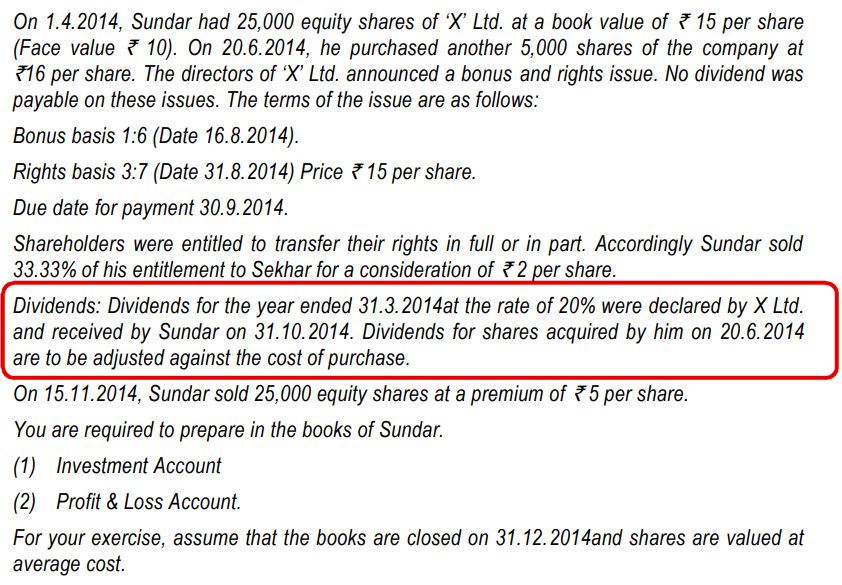

Kindly see the attached question... Dividend is declared for the year ended 31.03.2014 @ 20% i.e. when Sundar had 25000 shares.. and he will receive dividend on them... But later they say that... dividend for shares acquired on 20.06.14 to be adj. against cost.. QUERY: Company declared dividend only for year ended 31.03.2014, then how can we know the dividend % for shares acquired on 20.06.14. In solution study mat has taken 20% here as well...

Answers (4)

Dividend is declared for a year, post the year closure - you have a record date ( in this case some time in October) whoever has shares on that date , they will be eligible - for share purchased before the record date are to be adjusted against cost of shares. He acquired shares well before right / bonus issue ( on which dividend was not payable as per the question ) and hence dividend has to be adj against their cost

Sriram Somayajula Admin

Dividend is declared for a year, post the year closure - you have a record date ( in this case some time in October) whoever has shares on that date , they will be eligible - for share purchased before the record date are to be adjusted against cost of shares. He acquired shares well before right / bonus issue ( on which dividend was not payable as per the question ) and hence dividend has to be adj against their cost

But in this another illustration... nothing has been mentioned about dividend on rights and bonus issue... and in solution dividend for shares purchased on 01-06-14 has been adj. against cost... though rights and bonus shares were issued before the record date in Oct or they have assumed that dividend not paid on bonus and right share? kindly help sir...

Thread Starter

Deepak GuptaBut in this another illustration... nothing has been mentioned about dividend on rights and bonus issue... and in solution dividend for shares purchased on 01-06-14 has been adj. against cost... though rights and bonus shares were issued before the record date in Oct or they have assumed that dividend not paid on bonus and right share? kindly help sir...

They have assumed that dividends have not been paid on rights and bonus shares which is not a correct assumption. You can make a suitable note in the answers.