Forums

Marginal Relief Concept

Direct Taxation

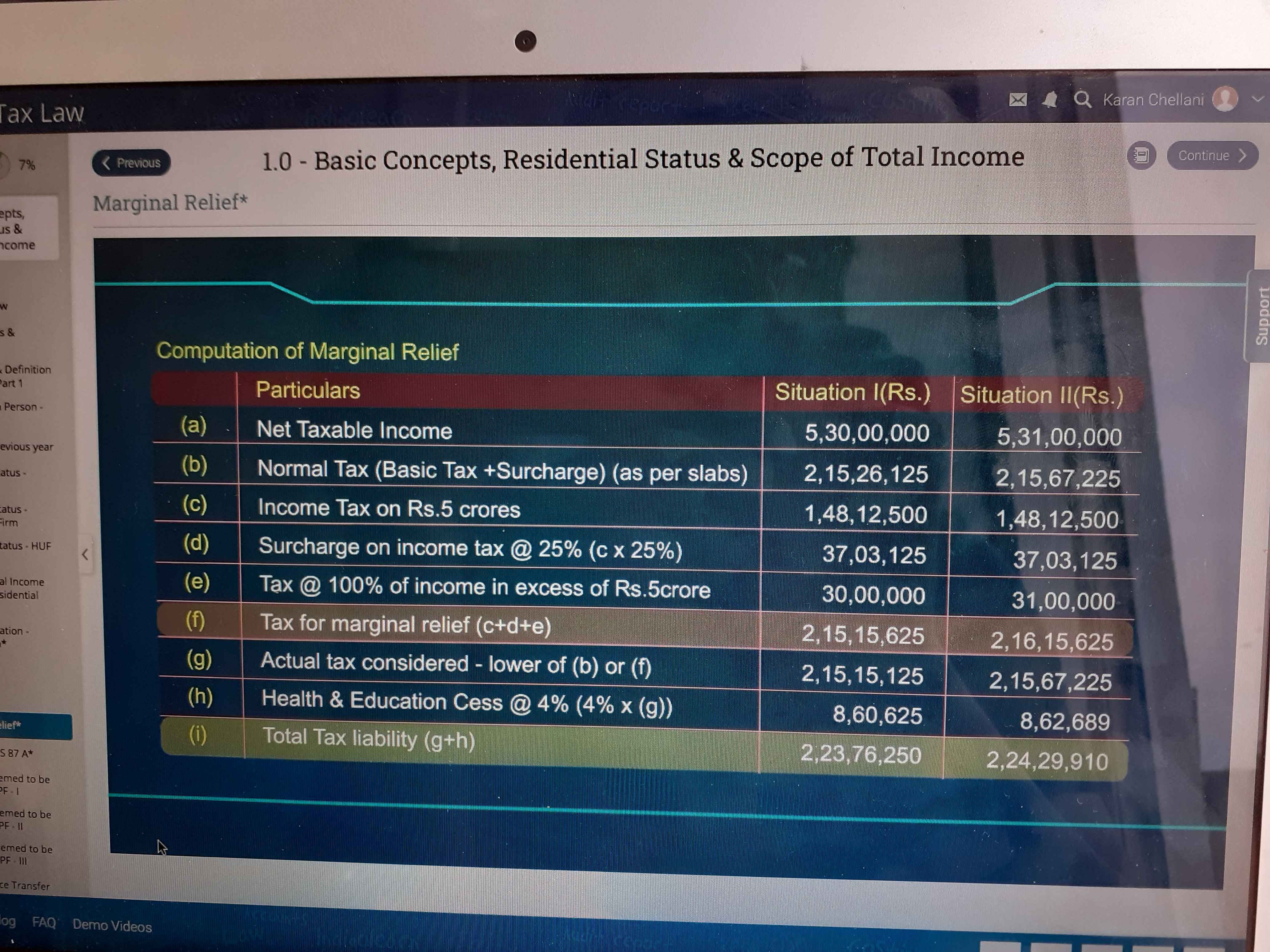

Hi, I was doing Marginal Relief topic. I wanted to have more clarity on this topic. My answer isn't matching with the answer on screen. So the question is- 1. What are the steps to calculate marginal Relief when the income is Rs. 5,30,00,000 of residual category? I request you to explain it in a more lucid manner than expressed in the illustration of marginal relief.

Answers (1)

Calculation of Marginal relief-Say,Individual total taxable income is 51 lakh in a financial year, applicable surcharge 10% surcharge applicable for 50 lakh and -1 crore. and he will pay 1,35,500 as surcharge,i.e for 1 lakh extra income he will be paying 135500/- so marginal relief of Rs.100,000 is given( means relief was given for variance in income results in tax exceeding over such variance of income.)