Forums

Marginal Relief

Direct Taxation

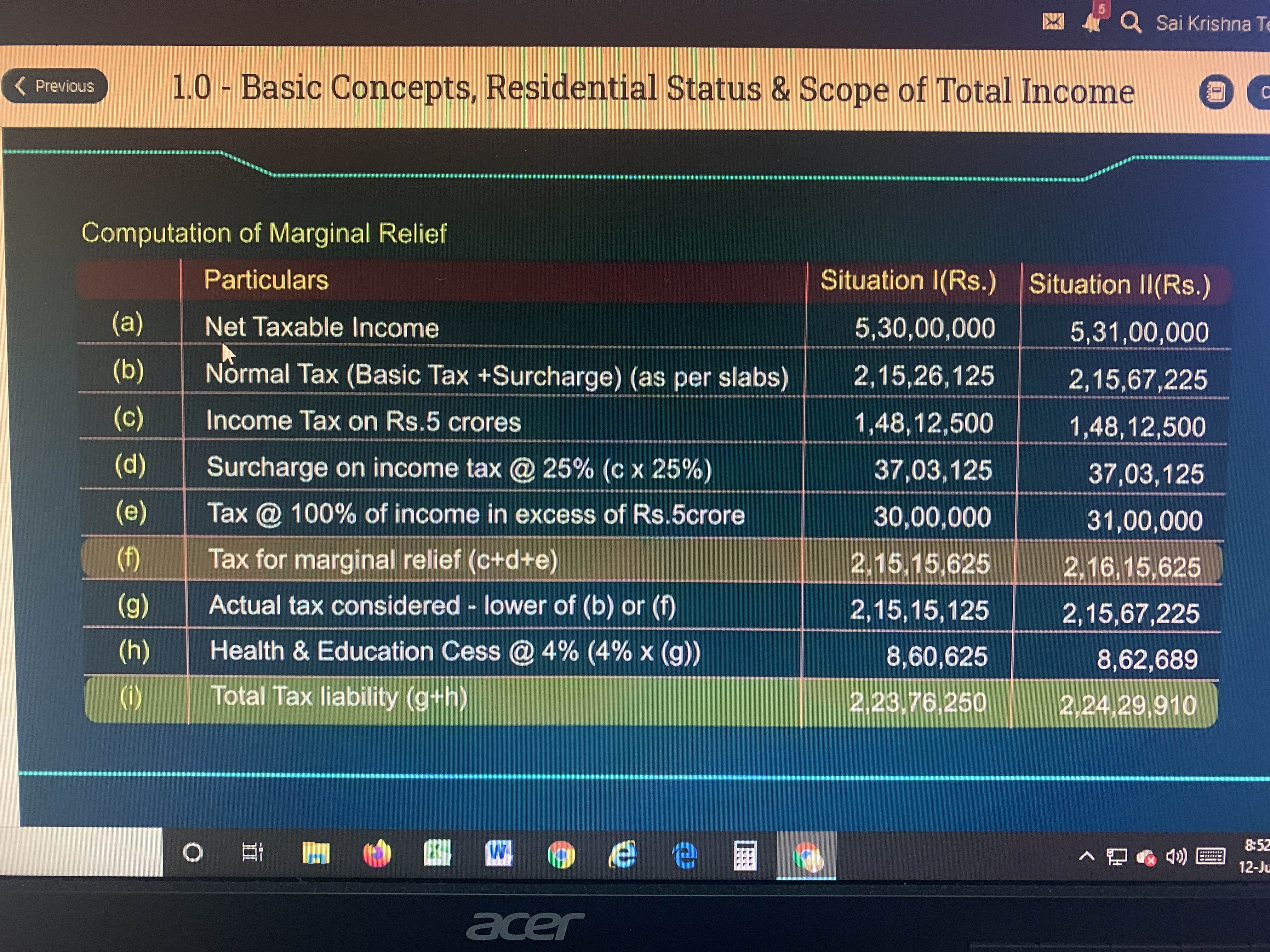

In the illustration 2 point d we have calculated surcharge @25% on point c Here the slab rate of surcharge is between 1cr-2cr is 15%.Why did we take 25% or should we constantly take 25 % irrespective of the slabs

Answers (1)