Forums

Maths

Maths & Stats

Find issue price of 11% bond of Rs.1200/- redeemable after 7 years at 10% premium if opportunity cost is 13% p.a. (a) 1145 (b)1195 (c)1205 (d)None of these

Answers (23)

Here there are 3 rates are given, they are 11%, 10%, 13%. As per the icai module we need only two rates, nominal interest rate and rate of return. (Refer the attached photo). I took 10% as nominal rate and 13% as rate of return and got the answer of 1051.xxx. which is not in the answer. But the thing is what is the purpose of that 11%. And please mention how you have got the answer by hit and trial.

Dharani Chakravarthi

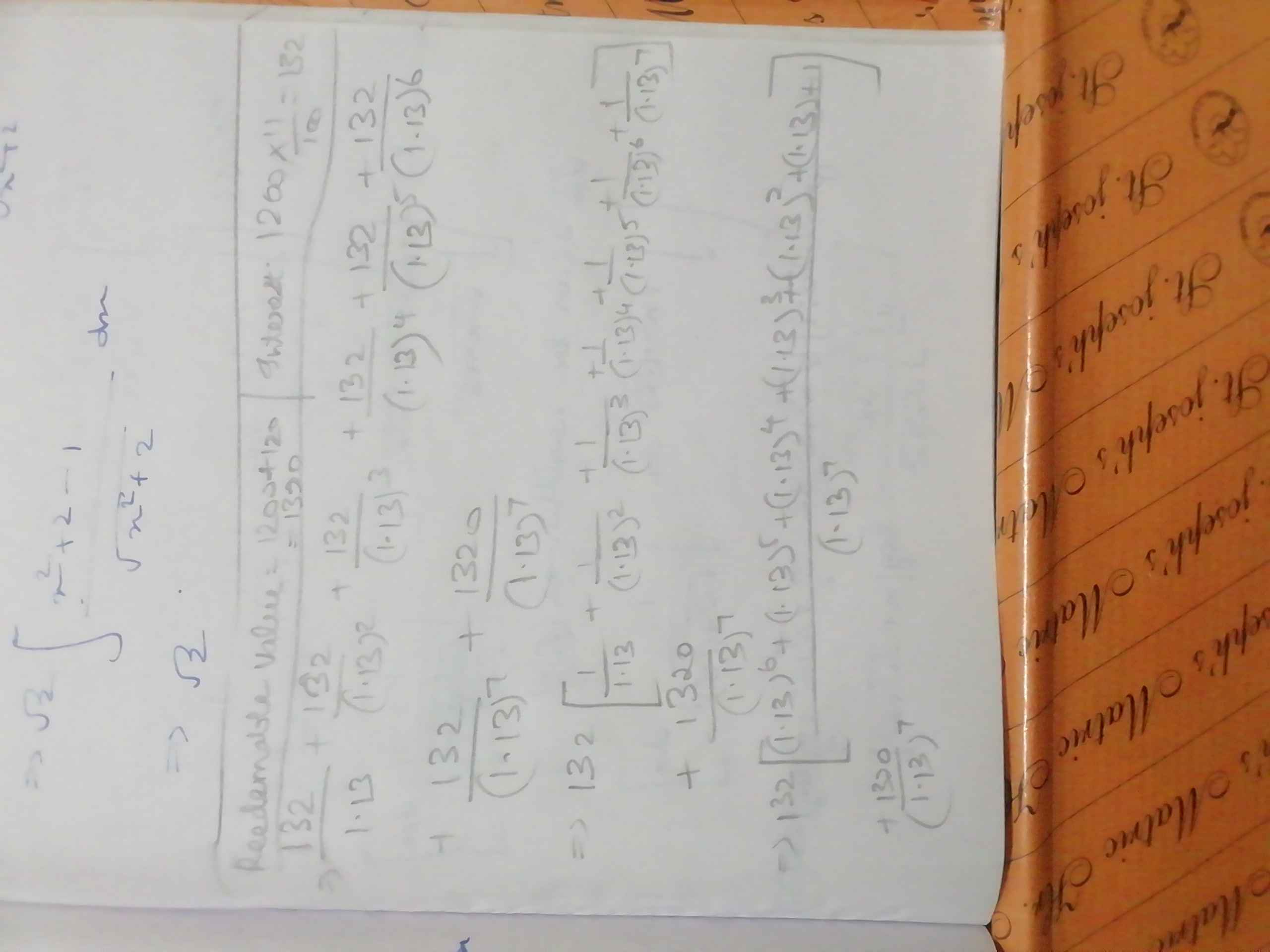

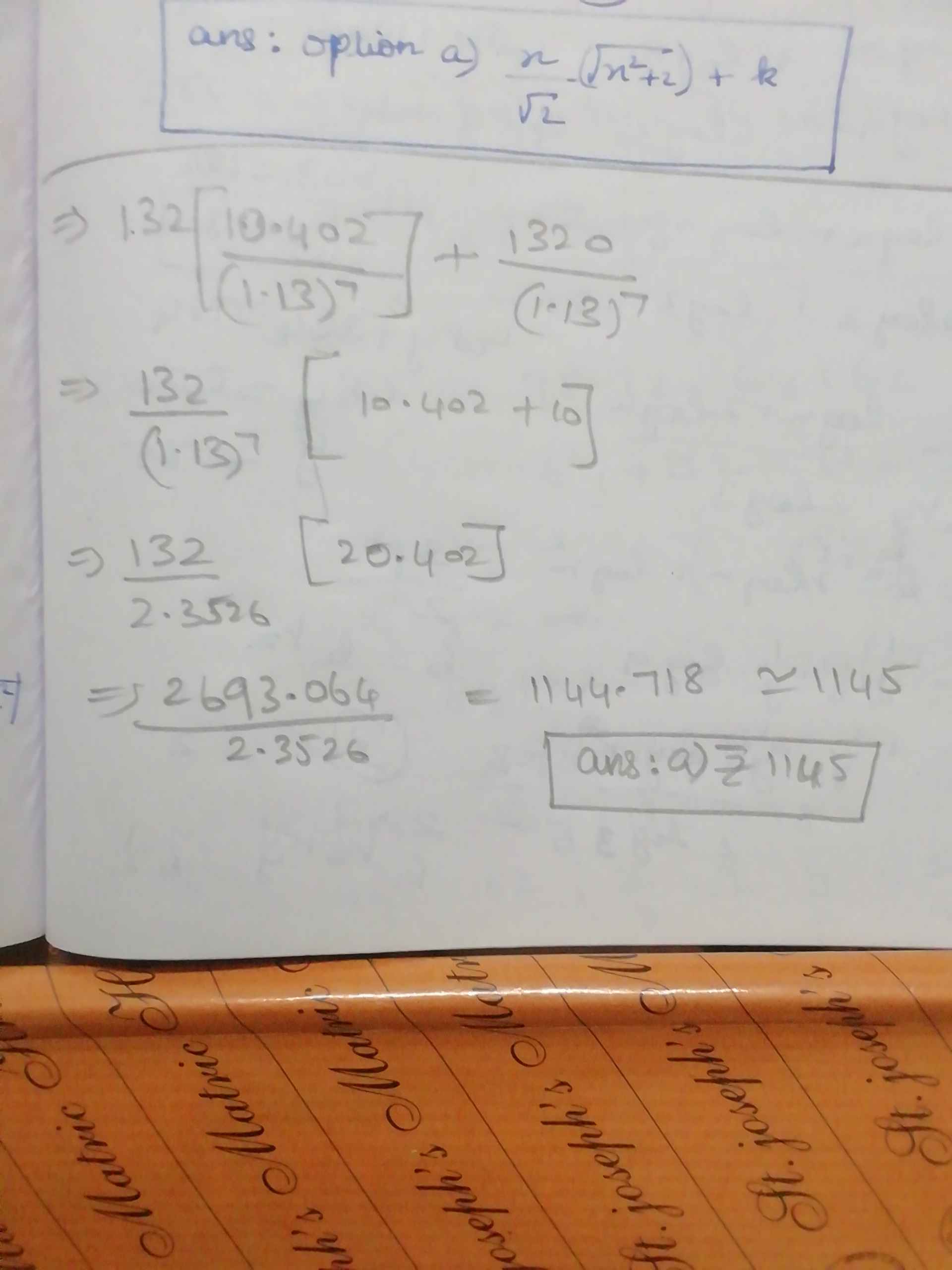

11% is the ineterest payable on the bond annually. Note: Step of (1.13) to the power(i.e. 1.13 + (1.13)^2 + (1.13)^3 + .........) + (1.13)^7 ) is not mentioned as it is long.

Ok bro, how come the bond payment of 1200 changed to 1320. Because in the working it is clear that the interest for the seventh year is calculated separately. Then how come it is so?

Alternatively, hit and trial method(but this is very approximate method and shall be used if the options have atleast some differences , like more than 5) : Face value of bond = Rs.1200 Redemption premium= 10% of Rs.1200= Rs.120 Value at redemption = Rs.1200 + 120 = Rs.1320. Interest on bond at 11% per year at face value of Rs.1200: Per year = Rs.1200 Ã? 11/100 = Rs.132 Interest For 7 years = 132 Ã? 7= Rs.924 Total amount payable on bond = Rs.1320 + 924 = Rs.2244. Opportunity cost is rate of return expected here. The face value of bond + opportunity cost of 13% at issue price for 7 years = Total amount payable on bond.(This part is where it is approximated) Opportunity cost at 13% on 1145(substitution / hit and trial)= 1145 Ã? 13/100 = 148.85 For 7 years: 148.85 Ã? 7 = 1041.95 = 1042 1042 + 1200 should be approximately equal to total amount payable. If it is true then the option is correct. So, here 1042 + 1200 = Rs.2242 approximately equal to 2244. So, option A) 1145 is the right answer.

Vijay K

Ok bro, then what is about that 10% premium

That is what , I have written at the top right corner in the first page- the repayable amount is face value +10% premium. i.e 1200 +120 =1320.

Vijay K

Ok bro, how come the bond payment of 1200 changed to 1320. Because in the working it is clear that the interest for the seventh year is calculated separately. Then how come it is so?

Interest for 7 year is not calculated separately, it is calculated like other years. The last addition for the whole amount is the final amount payable. See, the working provided and compare with the study material example, you can understand . The only difference is in this question we have redemption af premium, so we should consider it and add it too.

Dharani Chakravarthi

Interest for 7 year is not calculated separately, it is calculated like other years. The last addition for the whole amount is the final amount payable. See, the working provided and compare with the study material example, you can understand . The only difference is in this question we have redemption af premium, so we should consider it and add it too.

Yes bro, it my bad that I didn't understand. But now i got it very clearly. Thank you

Dharani Chakravarthi

Alternatively, hit and trial method(but this is very approximate method and shall be used if the options have atleast some differences , like more than 5) : Face value of bond = Rs.1200 Redemption premium= 10% of Rs.1200= Rs.120 Value at redemption = Rs.1200 + 120 = Rs.1320. Interest on bond at 11% per year at face value of Rs.1200: Per year = Rs.1200 Ã? 11/100 = Rs.132 Interest For 7 years = 132 Ã? 7= Rs.924 Total amount payable on bond = Rs.1320 + 924 = Rs.2244. Opportunity cost is rate of return expected here. The face value of bond + opportunity cost of 13% at issue price for 7 years = Total amount payable on bond.(This part is where it is approximated) Opportunity cost at 13% on 1145(substitution / hit and trial)= 1145 Ã? 13/100 = 148.85 For 7 years: 148.85 Ã? 7 = 1041.95 = 1042 1042 + 1200 should be approximately equal to total amount payable. If it is true then the option is correct. So, here 1042 + 1200 = Rs.2242 approximately equal to 2244. So, option A) 1145 is the right answer.

I have checked this method and turns out that this method is not applicable for every problem and has factual errors in it. I regret it and kindly request you not to follow this hit and trial method and instead follow the method provided in our book.

Dharani Chakravarthi

I have checked this method and turns out that this method is not applicable for every problem and has factual errors in it. I regret it and kindly request you not to follow this hit and trial method and instead follow the method provided in our book.

No bro. I understand the problem by that procedure you has done itself. But it took some time. So that's not the problem. I got little confused by that 10% premium. Then I got it as whole.

Vijay K

No bro. I understand the problem by that procedure you has done itself. But it took some time. So that's not the problem. I got little confused by that 10% premium. Then I got it as whole.

I understand that you confused, what I am saying is that don't use that hit and trial method because I found it to be wrong.