Forums

Mcq

Direct Taxation

What will be the answer Please explain

Answers (9)

Yoga Vishnu

In this situation, DA was declared in March 2021. So, it became due in FY 2020-21. It is taxable in FY 2020-21 on due basis

But sir isnt arrears of salary/retrospective changes taxed on receipt basis? So why is it taxed on due basis in this case

Yoga Vishnu

In this situation, DA was declared in March 2021. So, it became due in FY 2020-21. It is taxable in FY 2020-21 on due basis

Sir , As of rule PY income will be taxable in AY As per question salary/DA from 1.4.20 to 31.3.21 will be taxed in AY 21-22 on due basis only and they said the increase from 1.4.19 so , the increase (i.e for the yr 1.4.19 to 31.3.20 ) is received in PY 21- 22 that will be taxed on receipt basis

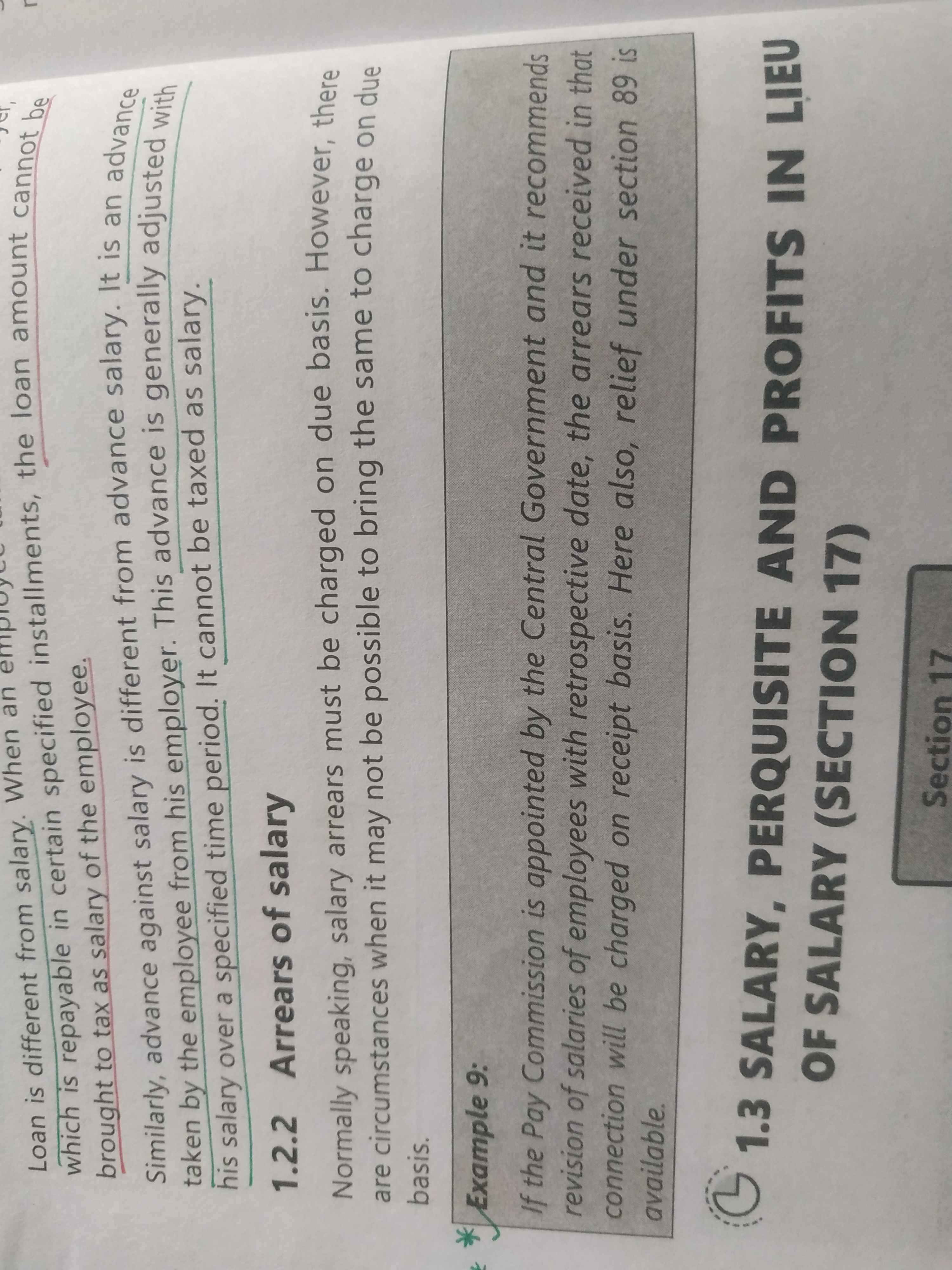

Section 15 of Income Tax Act:- The following income shall be chargeable to income-tax under the head "Salaries"â?? (a) any salary due from an employer or a former employer to an assessee in the previous year, whether paid or not; (b) any salary paid or allowed to him in the previous year by or on behalf of an employer or a former employer though not due or before it became due to him; (c) any arrears of salary paid or allowed to him in the previous year by or on behalf of an employer or a former employer, if not charged to income-tax for any earlier previous year. If you look into (c) - if arrears of salary "paid or allowed", if not taxed in earlier years, then only it is taxable in the current year. So, general rule of due or receipt whichever is earlier holds good in this case. FY 2019-20 arrear salary which is due in FY 2020-21 and received in FY 2021-22 is taxed in AY 2021-22 (due or receipt basis whichever is earlier) However, FY 2019-20 arrear salary is eligible for relief.

Thread Starter

Priyanka UdeshiBut sir isnt arrears of salary/retrospective changes taxed on receipt basis? So why is it taxed on due basis in this case

Based on Sec.15 Only 2 heads taxed on a receipt basis, They are Arrear salary & Bonus. All other heads contained salary is taxed on due / cash -Basis whichever is earlier.