Forums

PGBP - Failure to Deduct TDS by a co.

Direct Taxation

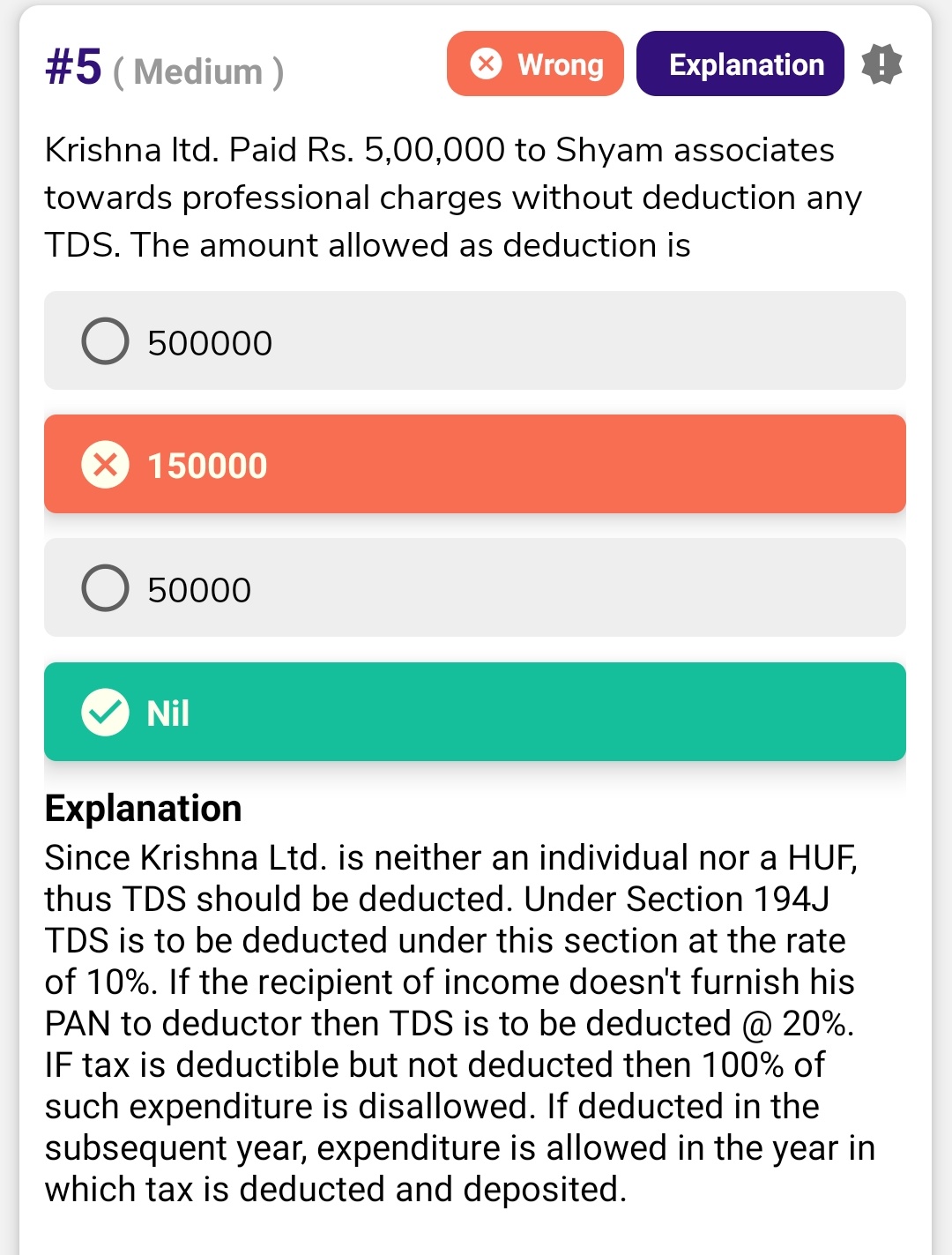

How is 100% of expenditure disallowed? Sec 40(a)(ia) tells that if TDS is not deducted while making pyt to resident 30% is disallowed right? So here Shyam associates is resident and 150000 is disallowed and 3.5 lakhs is allowed as deduction. Is there any other sec covering this ?

Answers (2)