Forums

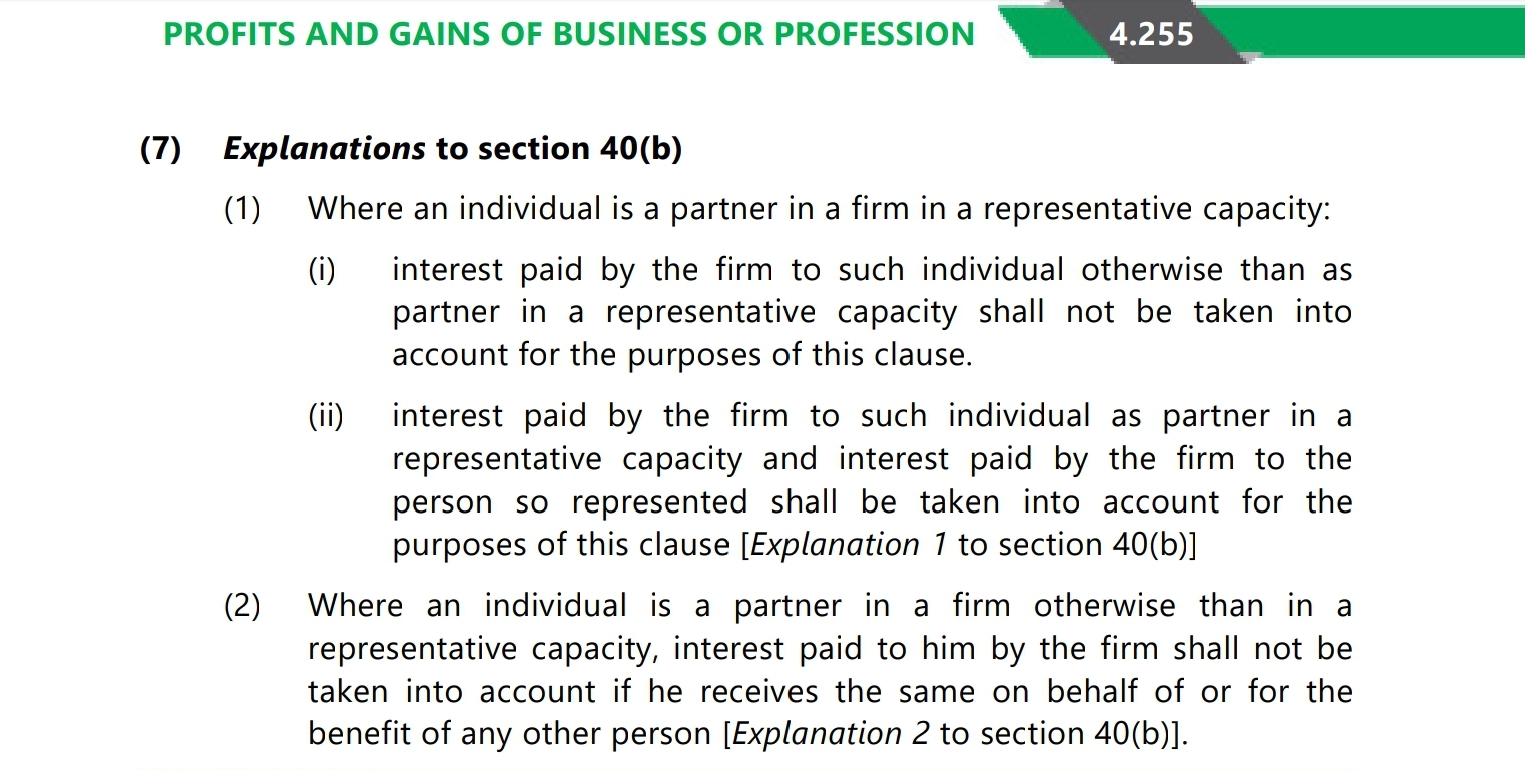

Partner provisions in pgbp

Direct Taxation

I need an explanation to this provision in simpler words...please do help me with this

Answers (2)

Best Answer

Eg . Firm - AB Partners A & B There is another firm AC where A is a partner If loan borrowed from AC and interest has been paid to A for AC's loan then A is a partner in representative capacity ( IT IS NOT PARTNERS LOAN so there is no dissallowance if he receives that interest on behalf of AC

Abishek M

Eg . Firm - AB Partners A & B There is another firm AC where A is a partner If loan borrowed from AC and interest has been paid to A for AC's loan then A is a partner in representative capacity ( IT IS NOT PARTNERS LOAN so there is no dissallowance if he receives that interest on behalf of AC

Thank you for the simplification its really helpful. 😊