Forums

Pgbp

Direct Taxation

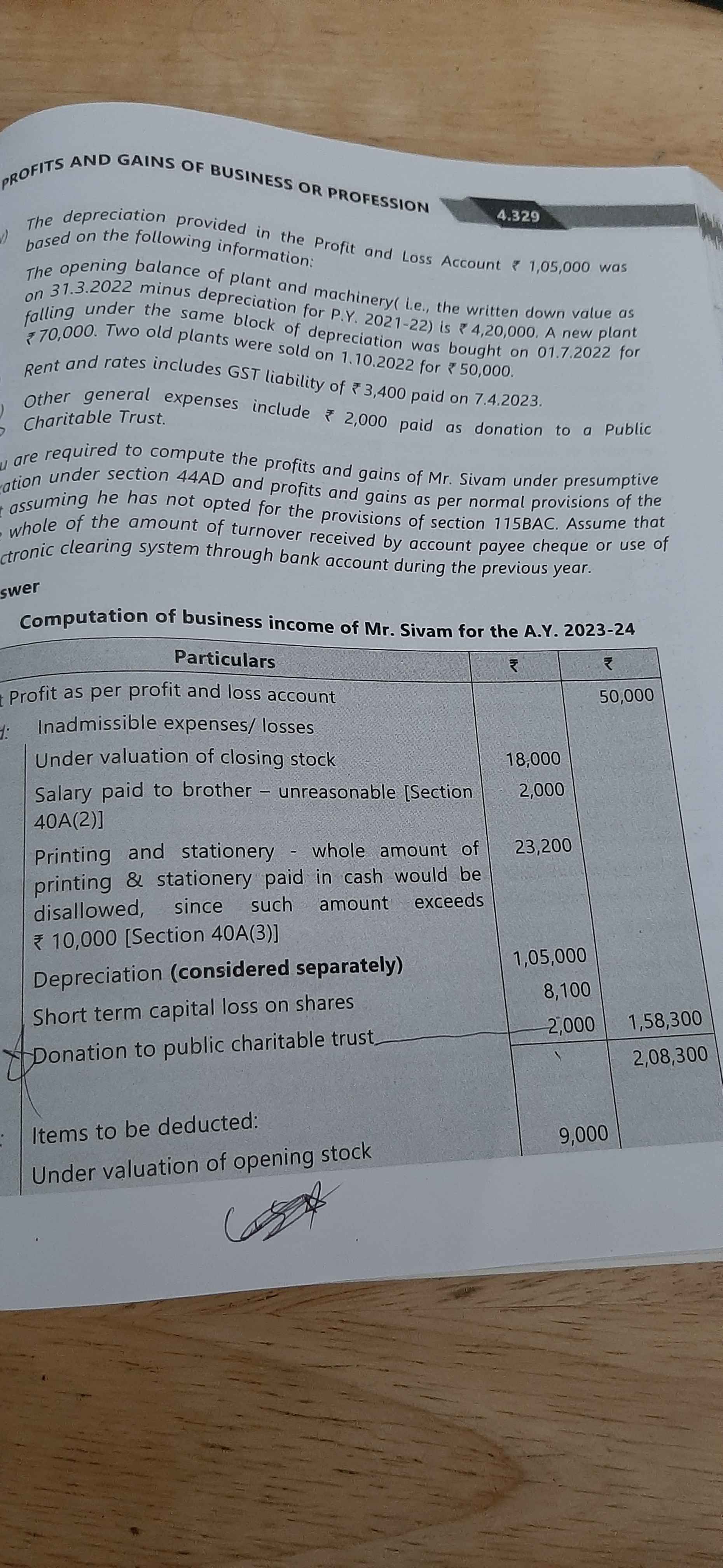

Y here donation to public charitable trust added back

Answers (4)

Best Answer

Thread Starter

Reetikaa R.

Donation to charitable trust allowed as deduction u/s 80G , not from PGBP. But , it is debited to PGBP p&L A/C as Expense . Hence to add back and allowed in deductions.