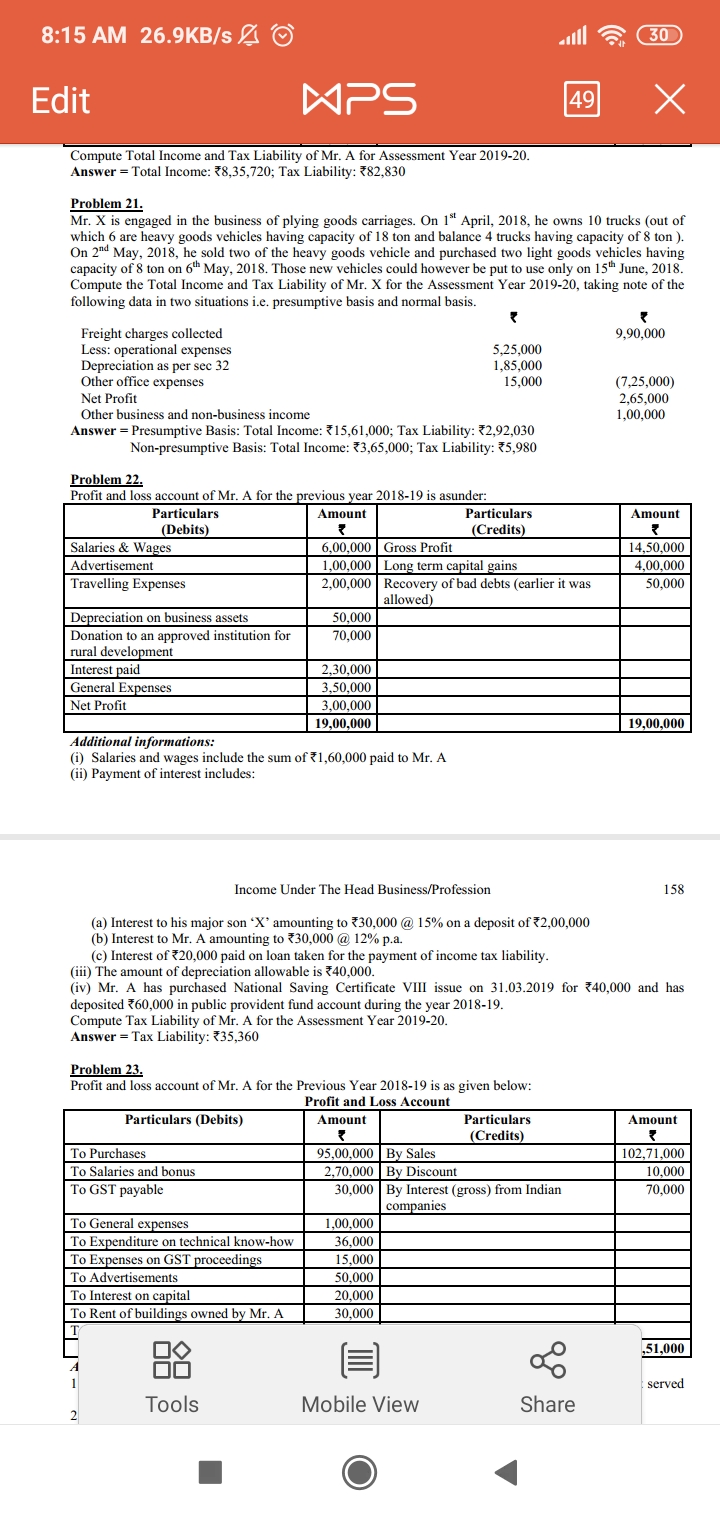

Forums

Pgbp

Direct Taxation

Sir in 22sum interest paid to major son on deposit is allowable expenditure or not

Answers (6)

Best Answer

Thread Starter

Mini PriyaBro why it is allowed

Allowed business expense u/s 36(1)(iii) the amount of the interest paid in respect of capital borrowed for the purposes of the business or profession You can borrow money from relatives for using it for your business and interest payable by you will be allowed as business expense. But if AO (Assessing Officer), thinks that you have paid excessive or unreasonable amount of interest to the relative as compared to the fair rate prevailing in the market, then excessive or unreasonable shall be disallowed.