Forums

Pre and post incorporation

Accountancy

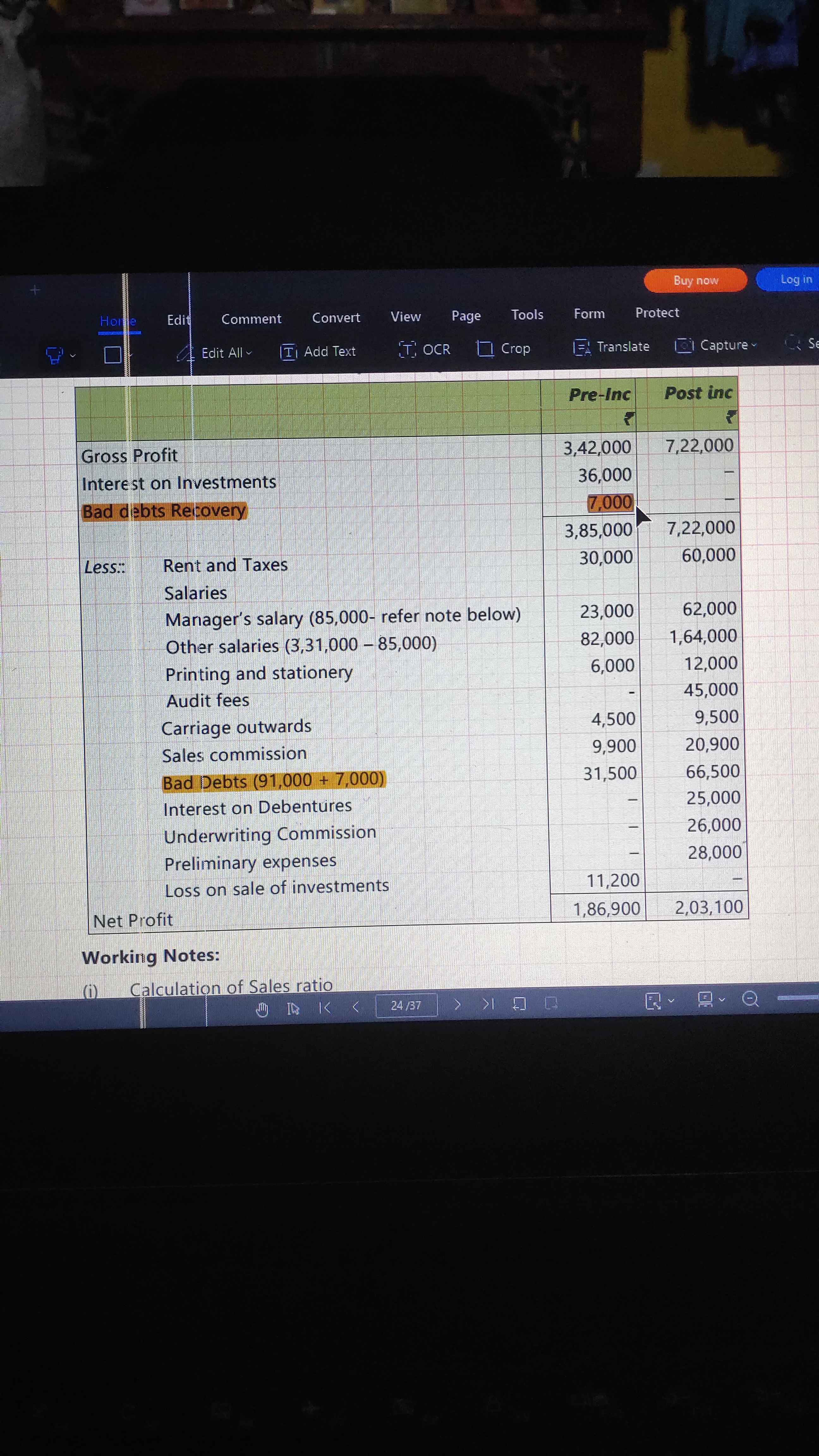

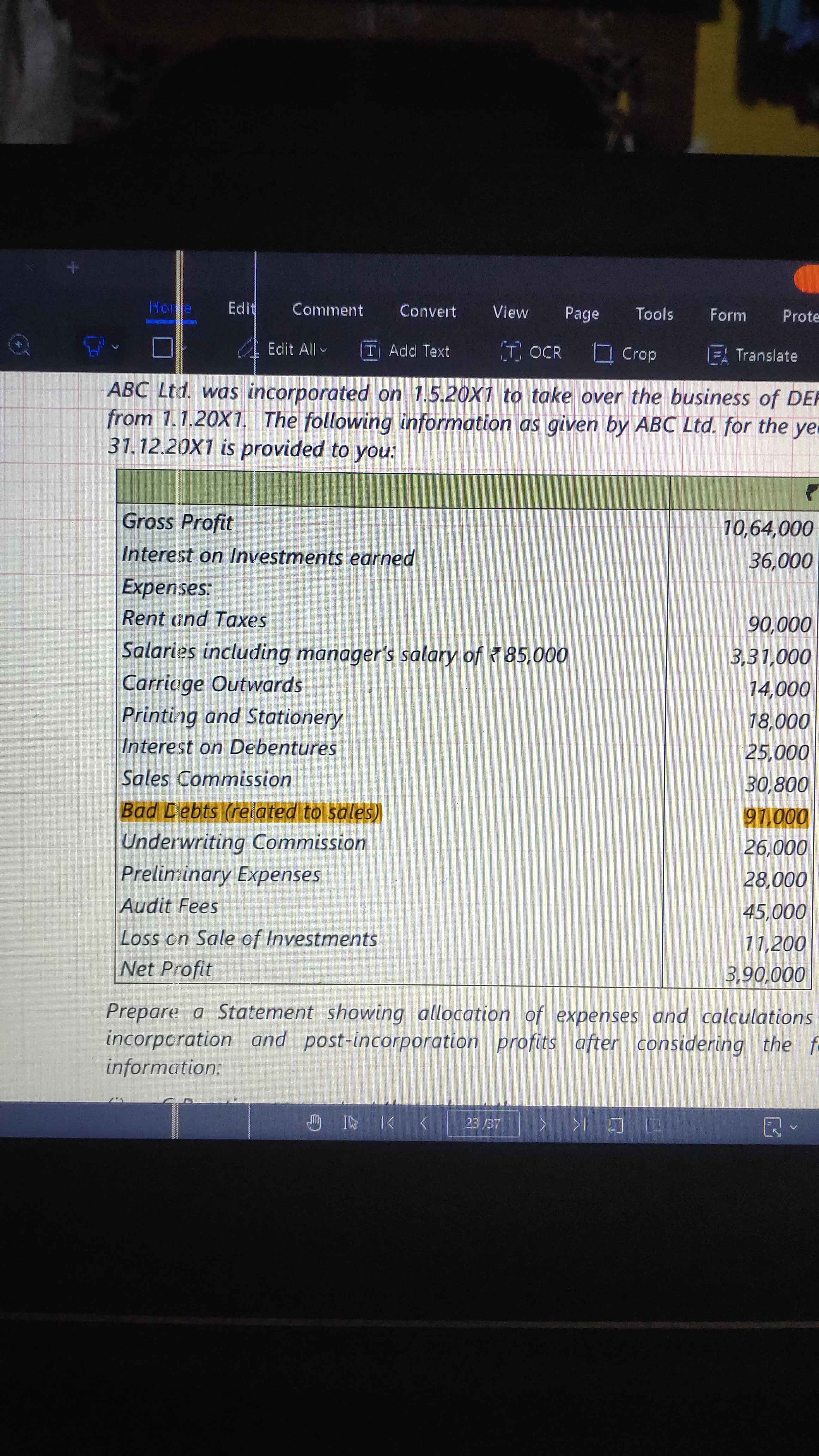

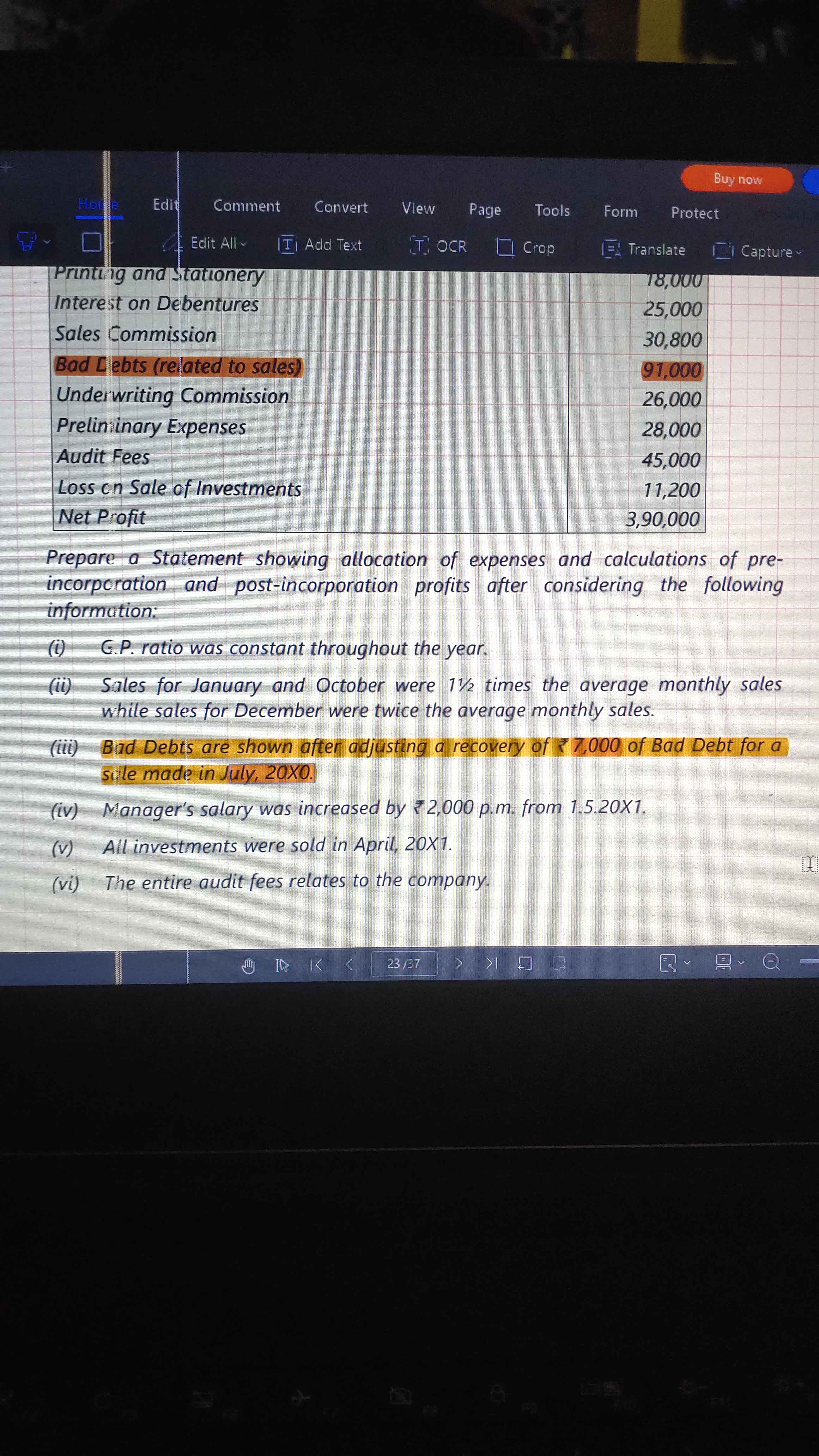

I have one doubt in ill7 icai model of pre and post incorporation chapter adjustment 3 bad debts recovery 7000 added in bad debts of 91000+7000 why add 7000 of recovery ??

Answers (4)

Best Answer

Till the year 20X1, we had Rs.7000 as bad debts. During the year 20X1 we recovered the bad debts of Rs.7000, so it is considered as Income and shown on the income side. The question says "Bad Debts after Adjusting the recovered Bad Debts is Rs.91000". Before recovery total Bad Debts are Rs.98000. We have the bad debts till 20X1 before the recovery so it should also be in the Bad Debts total amount.

Bad debt recovery is an income, but we have already debited it as a loss in P&L acc before acquisition, i.e., in the pre-incorporation period. So bad debt recovery is to be considered as pre-incorporation income. Bad debts is the loss which is directly related to sales. so this loss is to be apportioned to the pre and post incorporation period in sales ratio that's why we are again adding to bad debts and apportioning it

The recovery of Rs. 7,000 of a bad debt is for the sale made in pre-incorporation period. So, it has to be shown as income of Pre-incorporation period. But, since it has already been adjusted (reduced) from total bad debts, we have to add it back to arrive at the correct bad debts. Then, split it in sales ratio.