Forums

Registration

Indirect Taxation

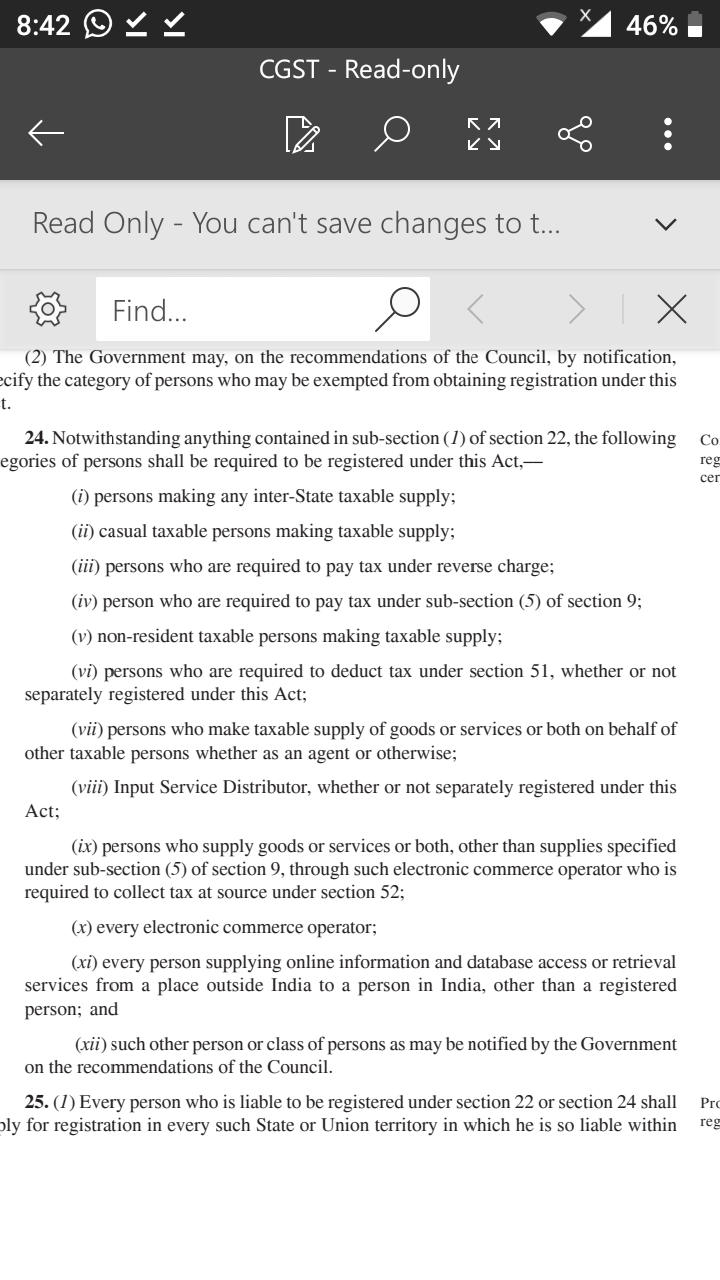

Sir, I have a doubt regarding GST (Registration chapter) in ipcc, Qn.No. 20(ii) in our material page no.118. Qn is as follows. Mr. S. N. Gupta of Rajasthan is engaged in trading of taxable good on his own account and also acting as an agent of Mr. Rishi of Delhi. His turnover in the financial year 2017-18 is off Rs. 1200000 on his own account and Rs. 900000 on behalf of principal. Both turnovers are intra state supply. Whether he is required to register under gst law? Answer. Sir has explained the answer as like this, The aggregate turnover (12L + 9L) = 2100000 which is upto the threshold limit of 4000000. Hence not eligible for registration. My point in this question is, Under section 24 ( compulsory registration)of CGST act there is one point which is like this, " Any person who supplies goods or services or both on behalf of other taxable person, whether as agent or otherwise" By looking at this point, S.N.Gupta is the agent of Mr. Rishi. So he comes under compulsory registration category. So he is liable for compulsory registration even without looking into his aggregate turnover.. I don't know whether am I right or wrong? Please help in this query sir..Â

Answers (13)

Agent is liable to be registered as per sec 24, when his/her principal is a taxable person [registered person or liable to be registered person] In the given case, question is silent about the details of principal.so the intention of the questioners is maybe to test the knowledge of threshold. I think we can suitably make the assumption for the answer also.

KEERTHI PRIYA

Yes assumption also correct ,but as per icai question was solved on basis of section 24 of CGST act so vedio also changed according.

How come the institute answer be right if there is a provision which makes him to register under compulsory registration u/s 24? Can u explain how the institute answer is right?

Pranav Connecting...

Agent is liable to be registered as per sec 24, when his/her principal is a taxable person [registered person or liable to be registered person] In the given case, question is silent about the details of principal.so the intention of the questioners is maybe to test the knowledge of threshold. I think we can suitably make the assumption for the answer also.

Agents registration is not based on principals registration. Refer point 7 in the attachment.

In question Gupta was dealing his supplies and rendering agency services in Intra- state but no where mentioned transaction between principle ,they may be Inter- state also as both are in different states ,then section -24 will attract. So, making one assumption is not enough.

KEERTHI PRIYA

In question Gupta was dealing his supplies and rendering agency services in Intra- state but no where mentioned transaction between principle ,they may be Inter- state also as both are in different states ,then section -24 will attract. So, making one assumption is not enough.

If you are taking it as inter state as both are different states then sir should have answered it as liable for registration since it is inter state supply of goods u/s 24. But he didn't take it that way. His approach was as turnover didn't cross 40lakhs limit it is not liable for registration. So that's why I got doubt. Now the answer is changed in the video. Anyone who wants to see the answer please refer video no. 21 in Registration topic.. Thanks.

Thread Starter

surya prakashAgents registration is not based on principals registration. Refer point 7 in the attachment.

I didn't get this attachment downloaded.i cleared storage of this app and restart again but still not getting.

I give answer to this based on this bare act . there said that " on behalf of taxable person". From this we should understand principal be a taxable person to make agent liable under this section. So on behalf of non taxable person-Not be liable. I don't know that any notification etc amended this.