Forums

Salary

Direct Taxation

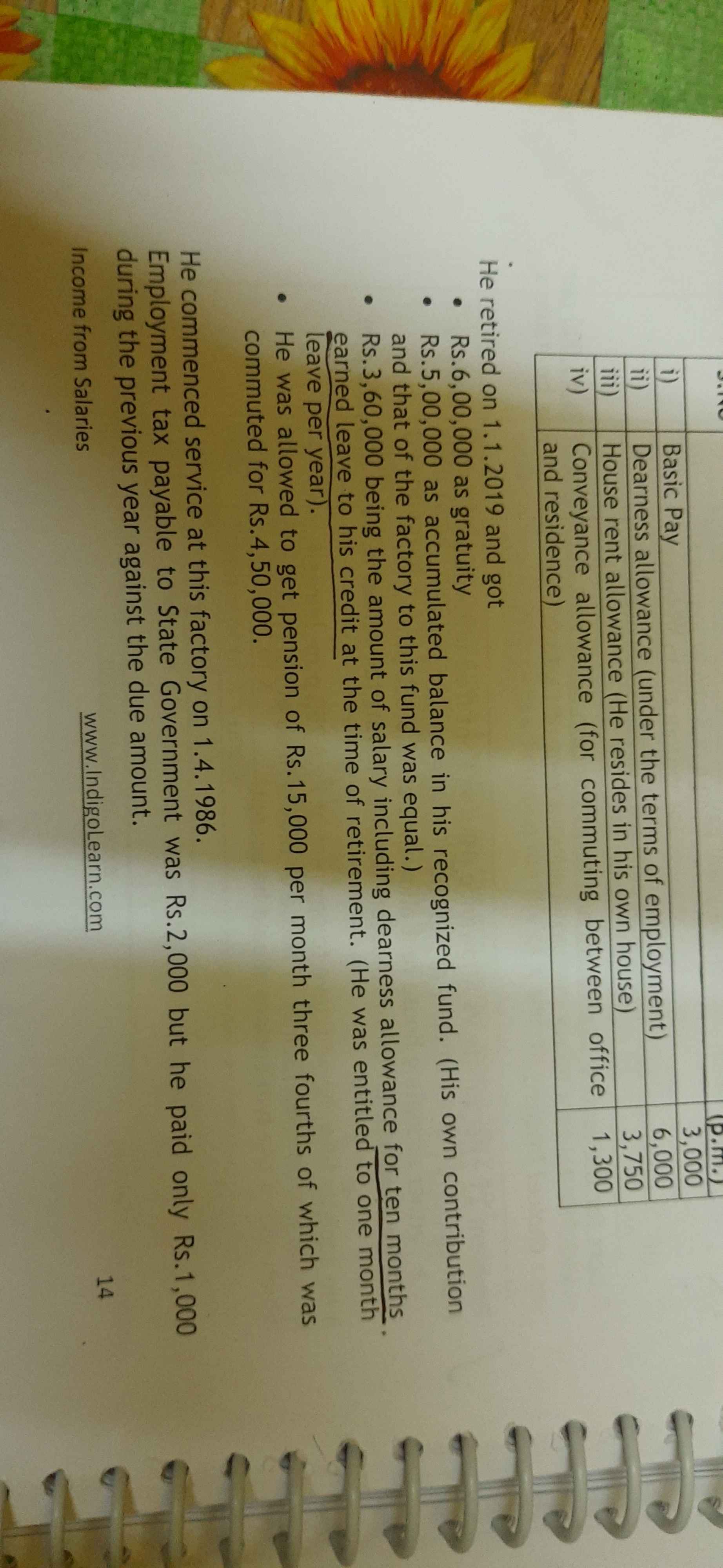

They have given " for 10 month earned leaved " then why should we take for entire 32 months (i.e) 1month for every year of service?

Answers (6)

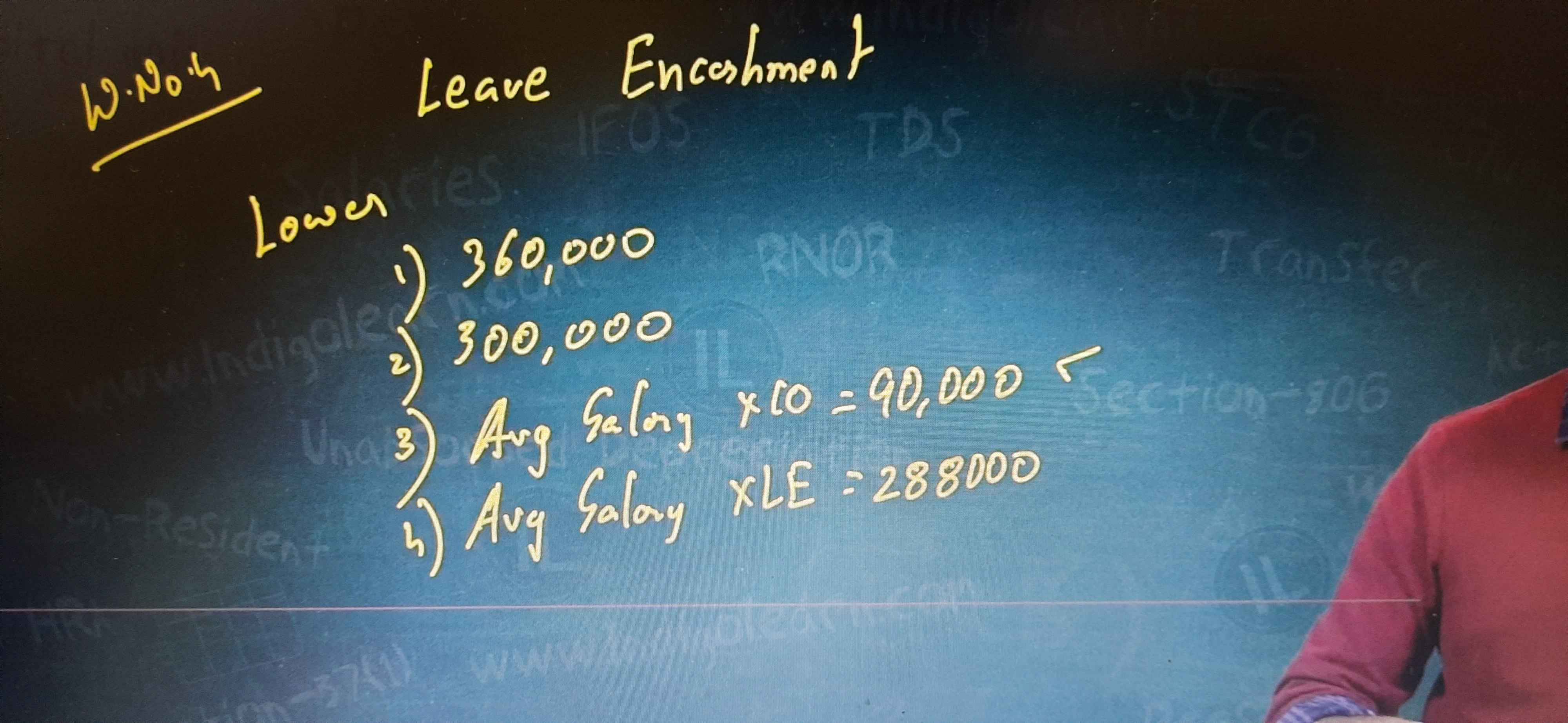

In calculation of Exempt portion in Leave encashment we consider least : Actual Statutory limit Avg sal * 10 months (earned) Avg Sal * Leave entitled In cal we considered Rs.90,000/- which is lowest among all, 32 months is for leave entitlement calculation (i,e every year 1 month=32 months )

Akshay jerry

What is the differences between allowance and perquisites?

Allowances are generally given as money. For e.g. House Rent Allowance. Perquisites are generally non-monetary. For e.g. Rent free accommodation.