Forums

Sec 194 C

Direct Taxation

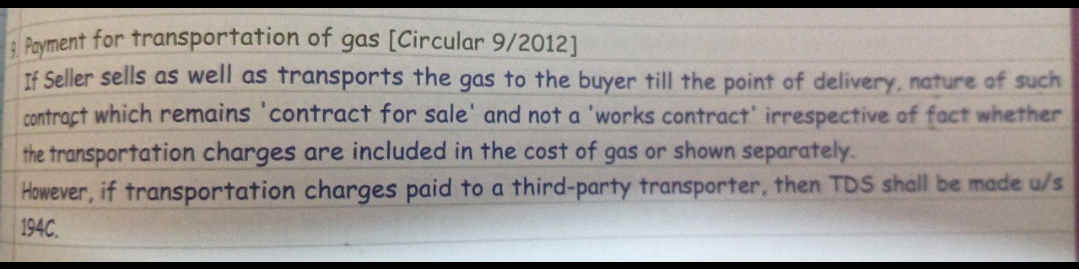

In this case , let's say I purchased gas value is 1L and if seller says he will not deliver at my place, now contract of sale is completed. But if seller agrees to deliver at extra amount of 10k for transportation, and it's charged in the same bill, ( here instead of 3rd party transporter, we are taking transport service from seller by paying extra ) Do we need to deduct TDS or not ?

Answers (1)