Forums

Sec 269SS

Direct Taxation

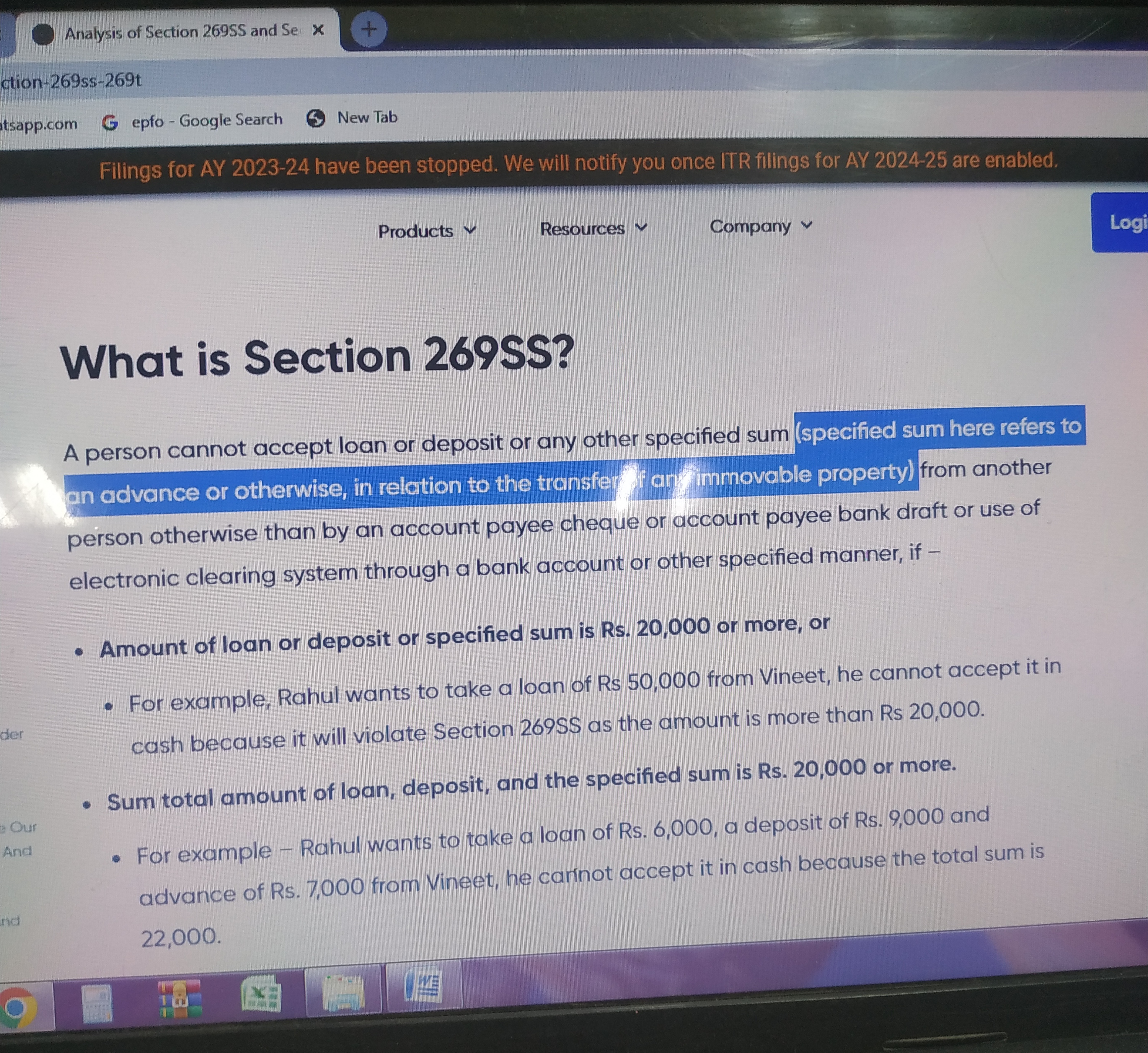

Here, advance refers to transfer of immovable property? or any other?

Answers (3)

Shiva Teja Faculty

It refers to transfer of immovable property only.

If advance is accepted relating to transfer of movable property, will 269ss gets attracted?

Thread Starter

Bumble BeeIf advance is accepted relating to transfer of movable property, will 269ss gets attracted?

Section 269SS covers only immovable property - “specified sum” means any sum of money receivable, whether as advance or otherwise, in relation to transfer of an immovable property, whether or not the transfer takes place.