Forums

TDS

Indirect Taxation

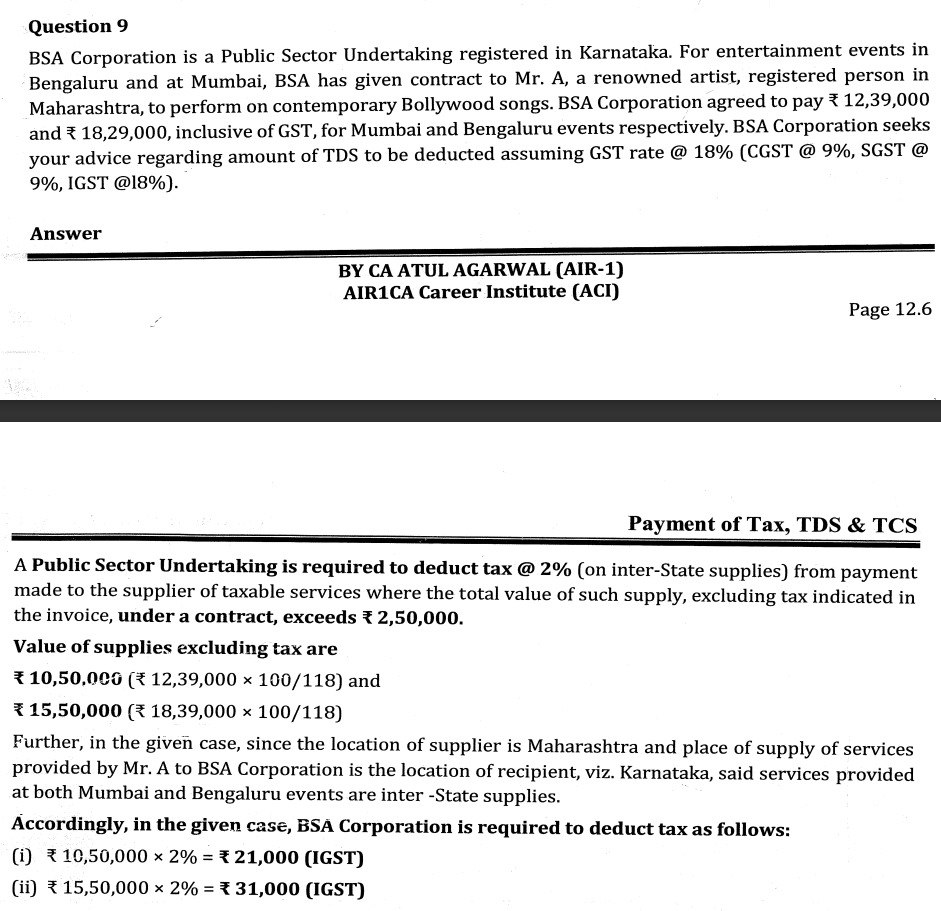

Please can anyone explain, why we are deducting TDS on the Mumbai invoice? Since the location of Supplier & place of supply are in the same state (i.e. Maharashtra) & location of recipient is Karnataka. So ideally it is exempted from GST TDS deduction. Please explain this case

Answers (1)