Forums

Tax liability computation

Direct Taxation

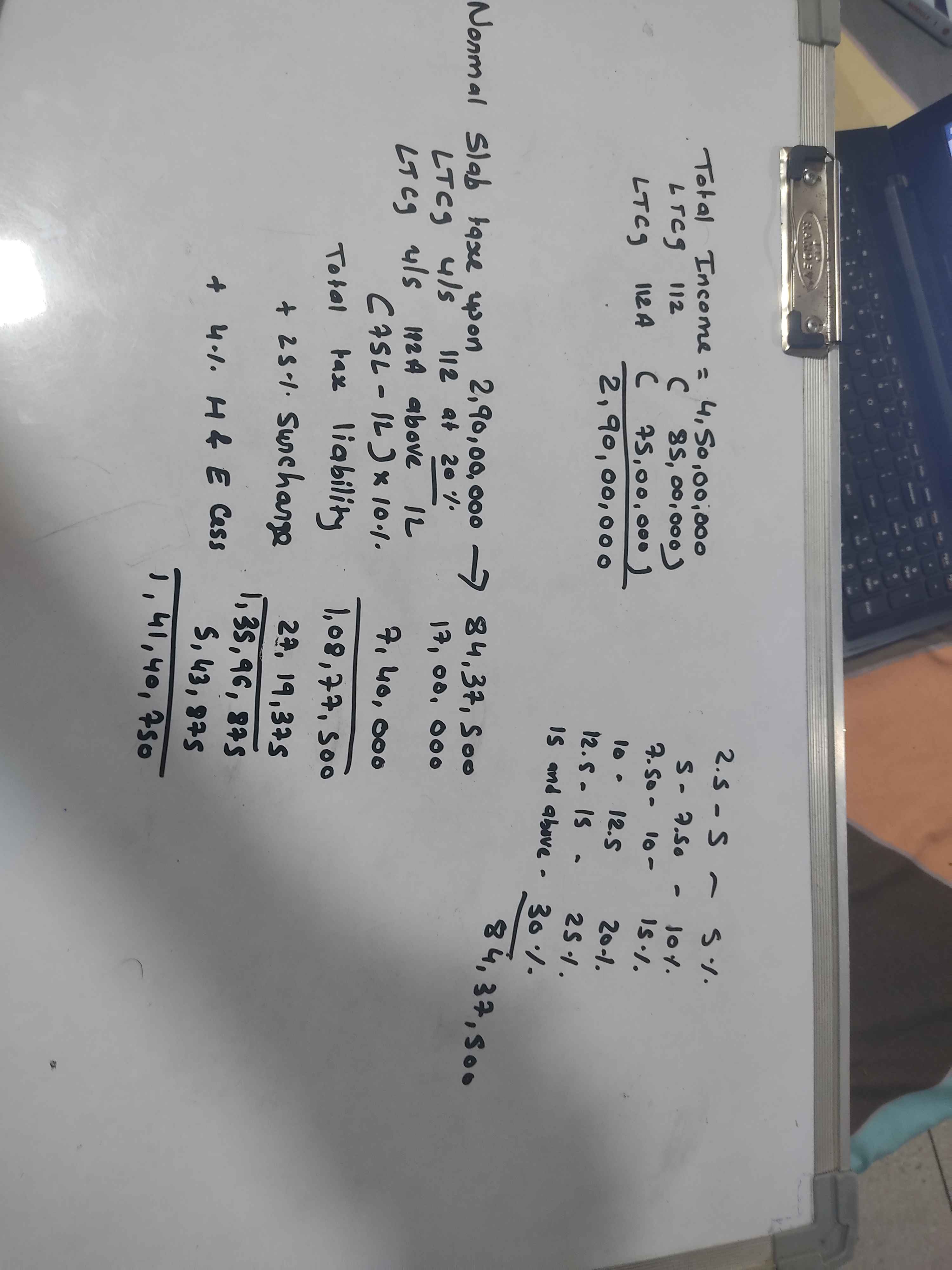

Mr. Rishabh, aged 65 years and a resident in India, has a total income of rs 4,50,00,000, comprising long term capital gain taxable under section 112 of rs 85,00,000, long term capital gain taxable under section 112A of rs 75,00,000 and other income of Rs 2,90,00,000. What would be his tax liability for A.Y. 2023-24. Assume that Mr. Rishabh has opted for the provisions of section 115BAC. (a) rs 1,41,40,750 (b) rs 1,38,86,990 (c) rs 1,38,84,390 (d) rs 1,39,81,240

Answers (7)

Thread Starter

Thasneem BanuThank you!

Sorry Option B is the right answer. Tax on LTCG u/s 112 - 85 lakhs*20% = 17 lakhs Tax on LTCG u/s 112A - 74lakhs( being in excess of 1lakh)*10% = 740000 Total Rs 24,40,000 Tax on Other income at slab rate as per Sec 115BAC on Rs 2,90,00,000 is Rs 8437500. Surcharge on Rs 8437500*25% = Rs 2109375 Surcharge on Rs 24,40,000 * 15% = Rs 366000 (+) HEC @4% = Rs 534115 Total Tax Liability is Rs 1,38,86,990

Thread Starter

Thasneem BanuSorry Option B is the right answer. Tax on LTCG u/s 112 - 85 lakhs*20% = 17 lakhs Tax on LTCG u/s 112A - 74lakhs( being in excess of 1lakh)*10% = 740000 Total Rs 24,40,000 Tax on Other income at slab rate as per Sec 115BAC on Rs 2,90,00,000 is Rs 8437500. Surcharge on Rs 8437500*25% = Rs 2109375 Surcharge on Rs 24,40,000 * 15% = Rs 366000 (+) HEC @4% = Rs 534115 Total Tax Liability is Rs 1,38,86,990

Shouldn't the tax liability on 2.9 Cr be 8,43,5000 considering the concessional slab of 3 lacs for senior citizen? Accordingly, surcharge on the same comes out to be 21,08,750. That clubbed with everything else gives total liability before cess as 1,33,49,750 and after cess it comes out to be Rs. 1,38,83,740. Is there a reason why concessional slab rate for senior citizen is not considered here? According to me the answer came to be C - 13883740

Kshitij Gupta

Shouldn't the tax liability on 2.9 Cr be 8,43,5000 considering the concessional slab of 3 lacs for senior citizen? Accordingly, surcharge on the same comes out to be 21,08,750. That clubbed with everything else gives total liability before cess as 1,33,49,750 and after cess it comes out to be Rs. 1,38,83,740. Is there a reason why concessional slab rate for senior citizen is not considered here? According to me the answer came to be C - 13883740

Okay nevermind, I got to know that concessional slab for seniors and super seniors is not applicable in 115BAC. So original answer of B is correct. Thanks.