Forums

Total income

Direct Taxation

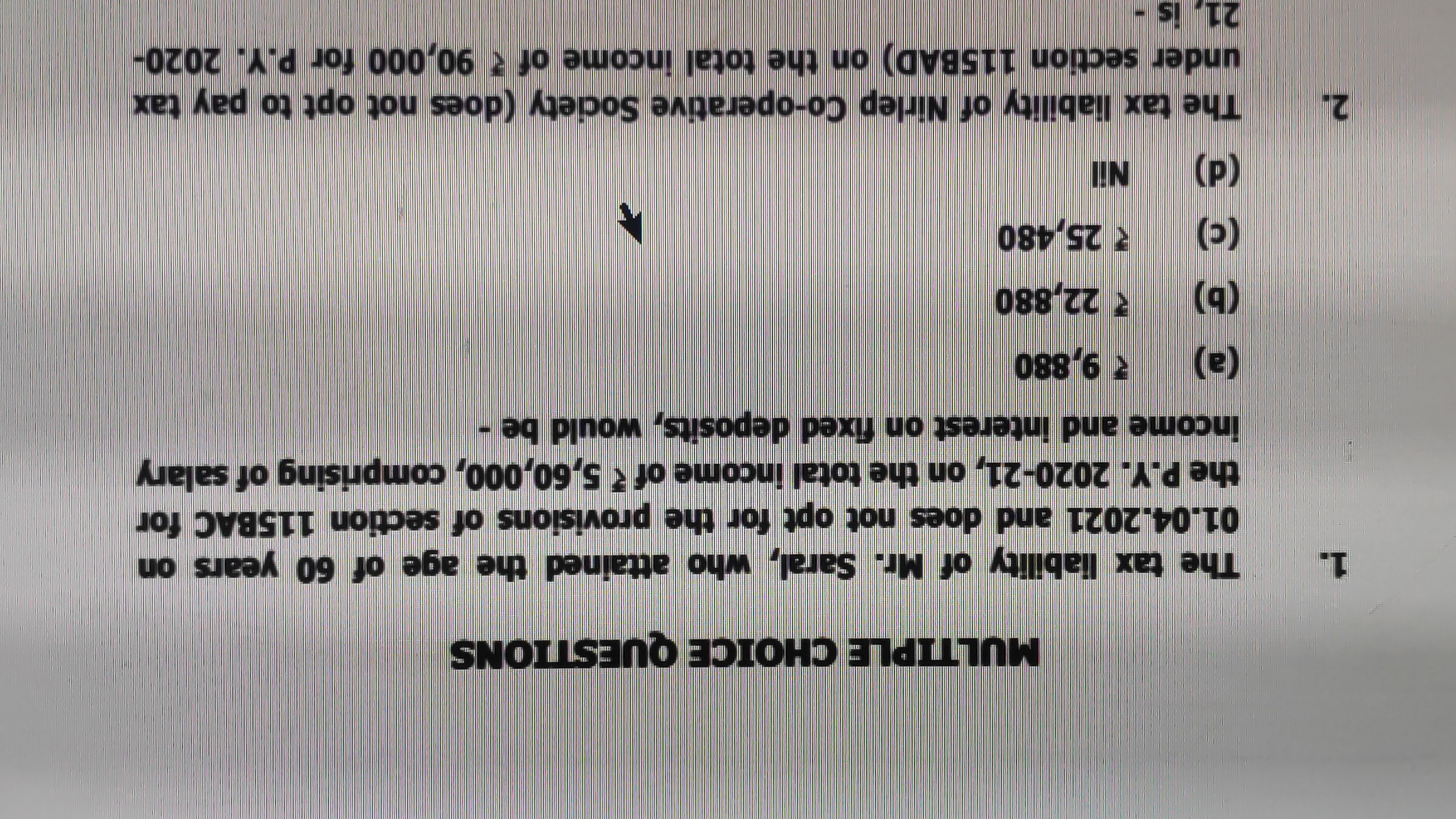

Total income is 5,60,000 not opted under section 115 BAC I got answer 25,480 But icai answer is 22,880

Answers (8)

Best Answer

Abhishek Purohit

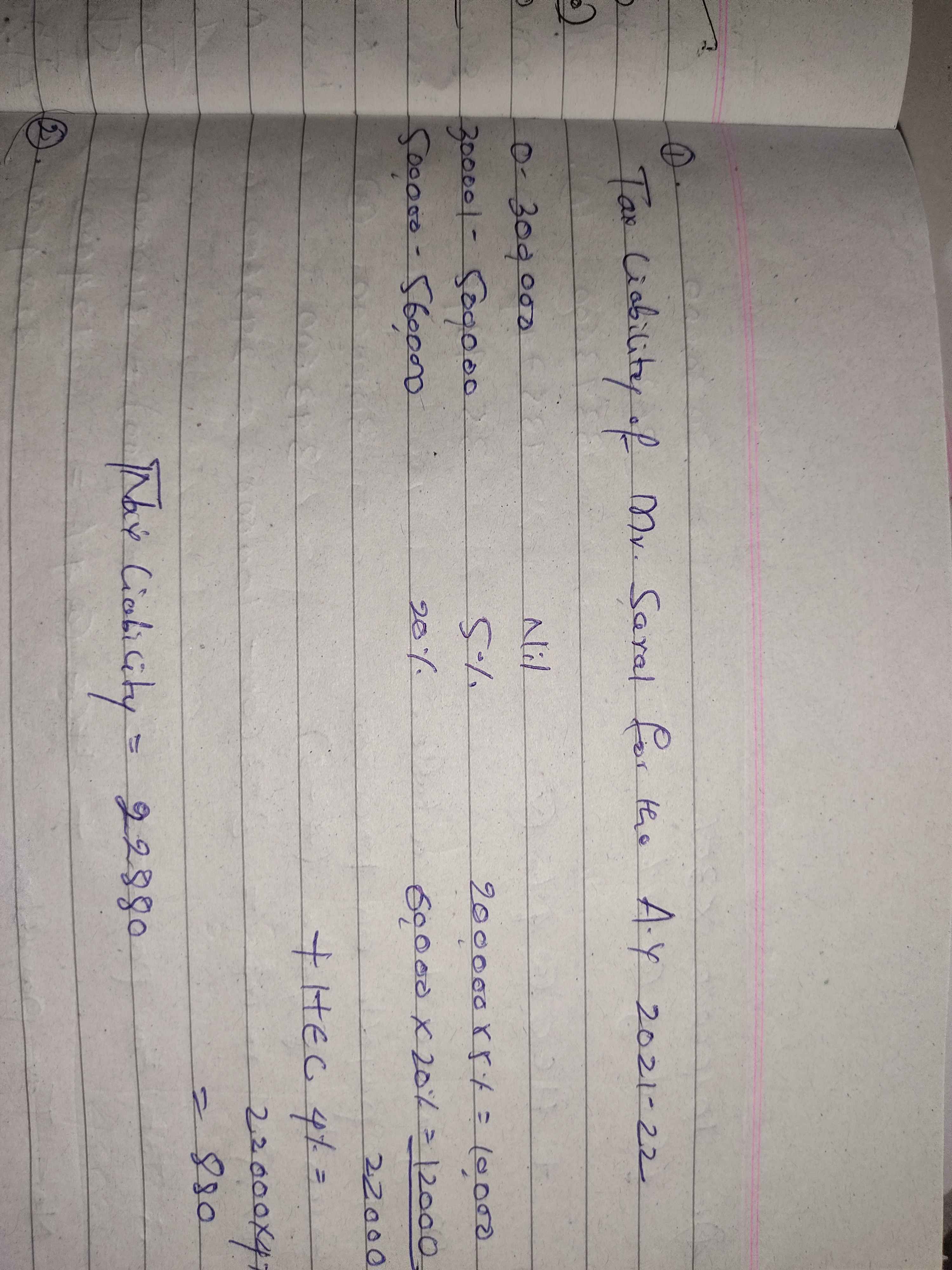

Mr saral - senior citizen So basic exemption upto 3 lakh

0 - 3,00,000 0% Nil 3,00,001 to 5,00,000 5% 10000 5,00,001 to 5,60,000 20% 12000 Total Tax 22000 Surcharge N/A 0 HEC 4% 880 Total Tax liability 22880

Thread Starter

ABDUL BASILBut Is the person need to be a senior citizen ie attain 60 on previous year itself or not ?

If a person attain 60yrs of age on 1st day of april,then it is considered as he attains that age on 31st march of the previous year.