Forums

Value of supply

Indirect Taxation

In This problem subsidy received from the state government is deducted from the price of the machine .why ? Can wesimply write as nil instead of deduction?

Answers (3)

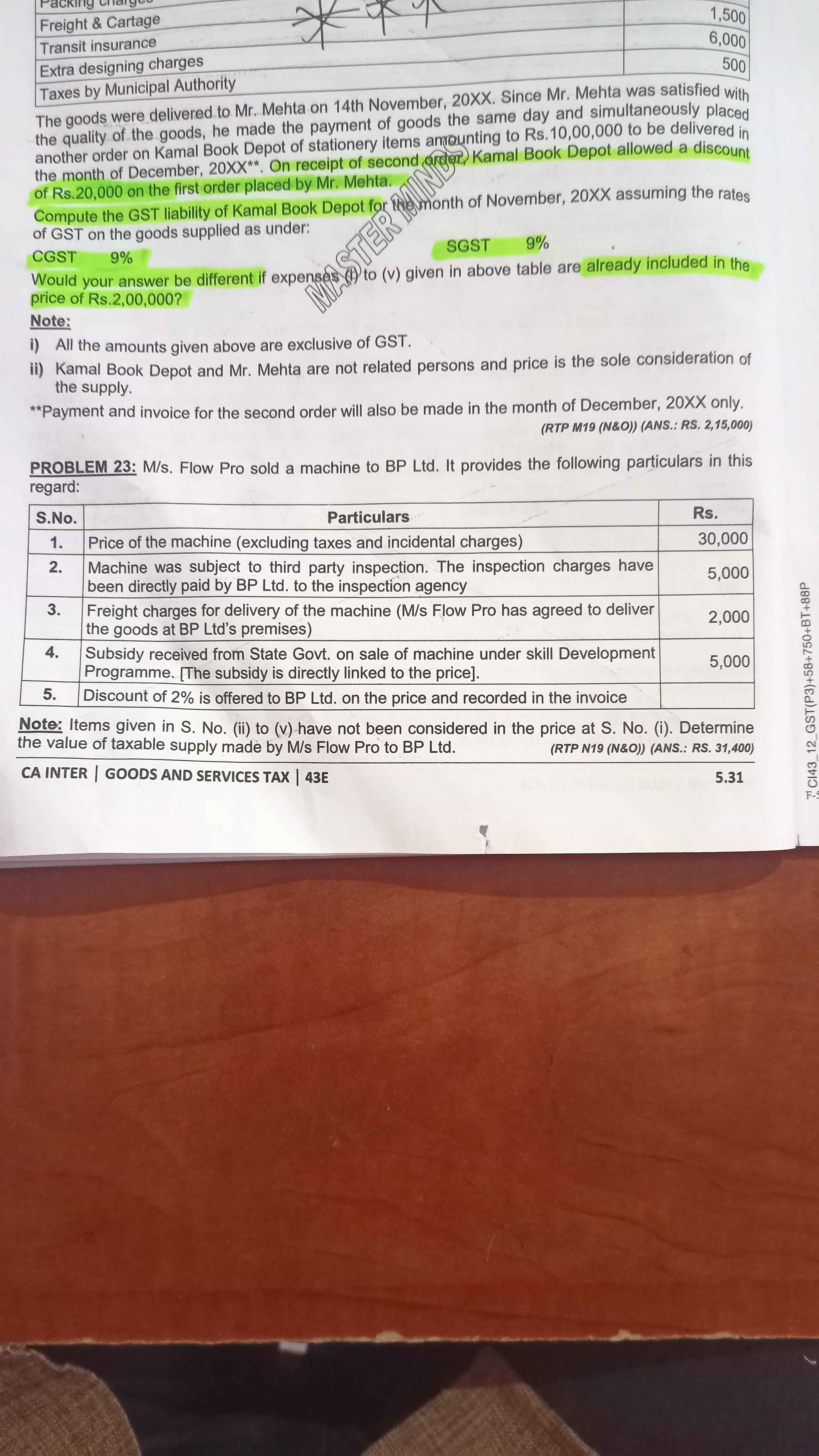

Section 15(2)(e): Subsidies # By Central/State Govt. -> Lower price after subsidy is the value [Subsidy received from Govt. is not included in the transaction as it is merely a valuation adjustment for computation of tax payable and not a supply] # Other than Central/State Govt. -> Subsidy is added to the value of supply and it does not lower the value -> supplier who receives the subsidy -> only subsidies directly linked to the price of goods/services