Forums

doubt

Financial Management

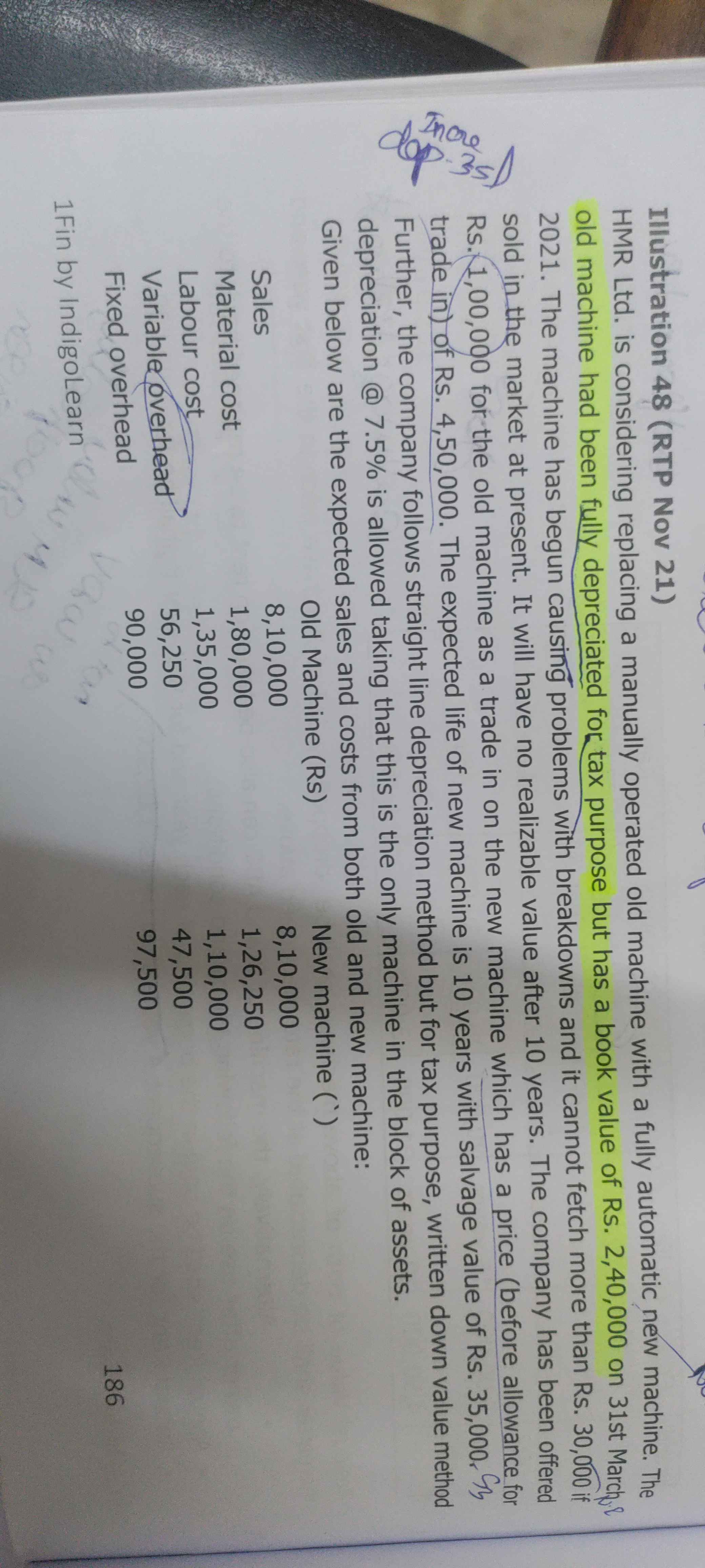

dep in of machine case of replacement to be calculated on cost of new machine here old machine cant be depreciated for the purpose of tax as it is 0 sir so how are u calculating dep on incremental value sir as 350000 sir but should be calculated as 450000*7.5%-0 dep for old machine only no sir Video Details ------------- Financial Management Investment Decisions #127. Illustration 48 - Q5 RTP Nov 21*

Answers (4)

Thread Starter

SHARINIDHA KSSince incremental depreciation means dep of new - old machine but here dep of old is 0 for the purpose of tax sir so I am not able to understand it sir

Depreciation is on money spent on an asset. money spent on thisnew asset is 3.5 lacs . though org cost is 4.5 lacs seller said they would give us teh new machine at 3.5 lacs if we give them the old machine - hence dep on amount spent i.e 3.5 lacs Since old machine is fully depreciated - the incremental dep is the dep on new machine